499r 2w 2pr Instructions

Patronos Y Agentes Retenedores Departamento De Hacienda De Puerto Rico

3 21 3 Individual Income Tax Returns Internal Revenue Service

Www Ssa Gov Employer Efw 18efw2 Pdf

October 19 Compliance Updates Aps Payroll

Assets Kpmg Content Dam Kpmg Us Pdf 19 10 194 Pdf

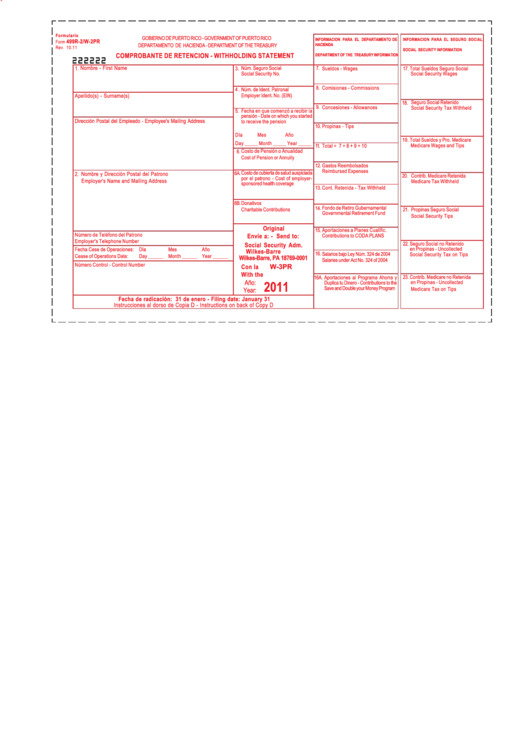

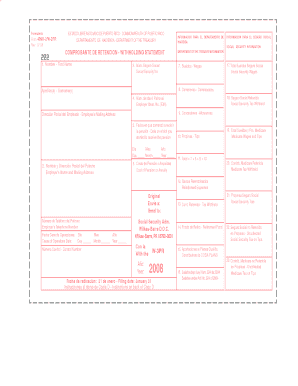

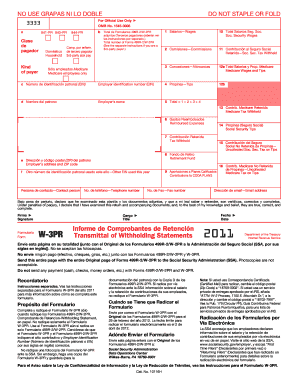

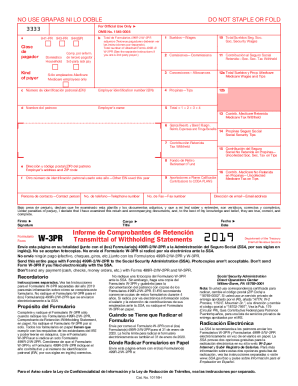

Ano Year Comprobante De Retencion

Employers with 3 or more W2 Forms to submit using private programs, that is, any program other than our Hacienda’s web program However, employers submitting 2.

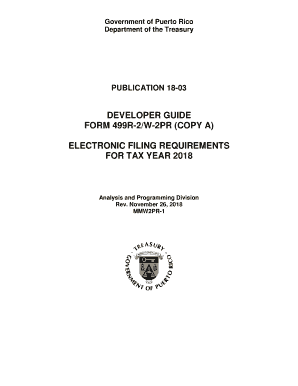

499r 2w 2pr instructions. Modified fields The 19 Form 499R 2/PR W2PR added Boxes C and D to report services rendered in agricultural labor (Box C) and services rendered by a minister of a church or religious order (Box D) Control Numbers The Puerto Rico Treasury Department has reserved the sequence between and for internal use. Instructions for filing Form 499R2/W2PR Copy A (W2) information to the Department of the Treasury on magnetic media using the MMW2PR1 format Who must use these instructions?. Employers with W2 Forms to submit using private programs, that is, any program other than our Hacienda’s web program However, employers submitting W2.

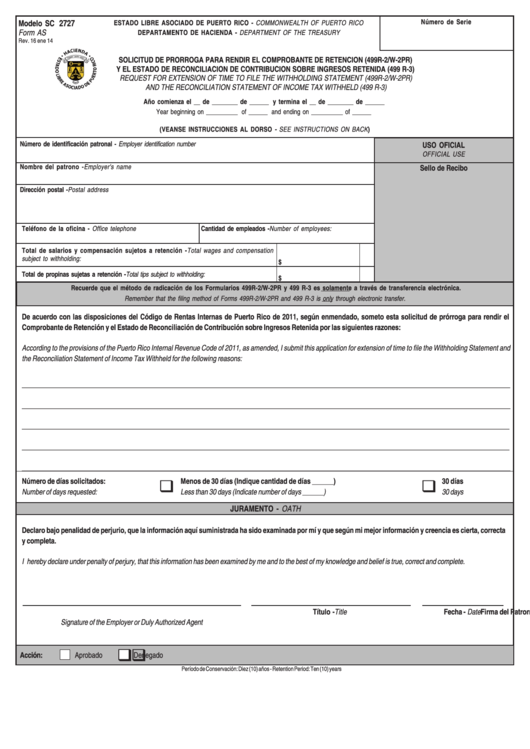

Outsourcing article 19 Electronic filing requirements for Form 499R 2/W 2PR ° 1 19 Electronic filing requirements for Form 499R2/W2PR October 23, 19 On October 3, 19, the Puerto Rico Treasury Department (PRTD) issued Publication 1901 to provide the electronic filing instructions for Form 499R2/W2PR. To request an extension of time to file the Withholding Statement (W2PR) and Reconciliation Statement of Income Tax Withheld (499R3) submit an electronic filing of Form AS 2727 The electronic application will be available through SURI Filings in paper form, via fax, mail or any other method will not be considered as filed. You will be penalized by th e Department of the Treasury.

499R2/W2PR “Patron – Employer” Language in the box has changed Formerly language instructing submission to the IRS and to the payee;. Forms 499R2/W2PR and 499R2c/W2cPR – Withholding statements and corrections to withholding statements A new box is provided to report if any payment to an employee is for Services rendered by a qualified physician who has a valid tax decree under Act 1417 (known as the “Incentives Act for the Retention and Return of Medical Professionals”) (Option A). Forms 499R2/W2PR – Withholding Statements clarifies the instructions of Box F (Others), to identify the classification of services rendered by the employee included in this box payments to professionals regarding hardtofill positions under Section 23 (a) of the Incentives Code – Code J.

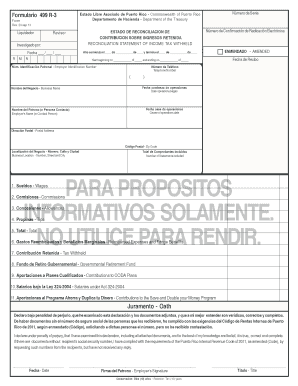

3 IMPORTANT INFORMATION Purpose of this Publication To provide the electronic transfer filing instructions for Form 499R2c/W2cPR using the EFW2CPR format Users of this Publication Employers submitting Form 499R2c/W2cPR by text file Mandatory Electronic Filing You must file all Corrected Withholding Statements electronically through SURI using EFW2CPR format. This amount must be included on the Employee’s Form 499R2/W2PR You will need to create Tax Adjustment records for each employee who was given health coverage during the year using this special item and entering the Amount of the health care cost in the Taxable Earnings field of the Tax Adjustment Allocated Tips. Forms 499R2/W2PR – Withholding Statements clarifies the instructions of Box F (Others), to identify the classification of services rendered by the employee included in this box payments to professionals regarding hardtofill positions under Section 23 (a) of the Incentives Code – Code J.

Employers with W2 Forms to submit using private programs, that is, any program other than our Hacienda’s web program However, employers submitting W2. COMPROBANTE DE RETENCION 499R2/W2PR MANUAL DE USUARIO Página 13 Colecturía Virtual IV Presentación del Comprobante de Retención 499R2/W2PR Para imprimir su Comprobante de Retención 499R2/W2PR oprima el botón de que se encuentra en la esquina superior izquierda. Modified fields The 19 Form 499R2/PR W2PR added Boxes C and D to report services rendered in agricultural labor (Box C) and services rendered by a minister of a church or religious order (Box D) Control Numbers The Puerto Rico Treasury Department has reserved the sequence between and for internal use.

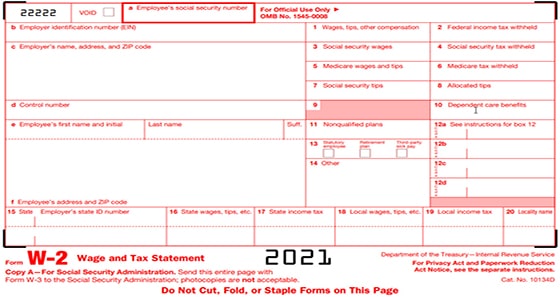

I have a 499r2/w2pr from working in puerto rico They have taken federal taxes out as well as medicare taxes, how do i file and must i file if i am not a PR resident?. Instructions for filing Form 499R2/W2PR Copy A (W2) information to the Department of the Treasury through electronic transfer using the MMW2PR1 format Who must use these instructions?. Instructions for filing Form 499R2/W2PR Copy A (W2) information to the Department of the Treasury through electronic transfer using the MMW2PR1 format Who must use these instructions?.

Employers with 5 or more W2 Forms to submit What if I have 5 or more W2s and I send you paper W2s?. Instructions for filing Form 499R2/W2PR Copy A (W2) information to the Department of the Treasury on magnetic media using the MMW2PR1 format Who must use these instructions?. The Puerto Rico Treasury Department issued Informative Bulletin 1818 with the new electronic filing requirements for Forms 499R2/W2PR and Informative Returns for 18 What’s new all transactions related to withholding taxes will be managed electronically through the Internal Revenue Integrated System (SURI).

Download puerto rico w 2pr instructions Elección para el pago de la Contribución Especial a distribuciones de dividendos y pago por adelantado de la Contribución Especial a distribuciones implícitas 1 Commonwealth of Puerto Rico Department of the Treasury PUBLICATION 1504 FORM 499R2/W2PR (COPY A) ELECTRONIC FILING REQUIREMENTS FOR TAX. You will be penalized by th e Department of the Treasury. Employers with 3 or more W2 Forms to submit using private programs, that is, any program other than our Hacienda’s web program However, employers submitting 2.

Modified fields The 19 Form 499R2/PR W2PR added Boxes C and D to report services rendered in agricultural labor (Box C) and services rendered by a minister of a church or religious order (Box D) Control Numbers The Puerto Rico Treasury Department has reserved the sequence between and for internal use. Below are five simple steps to get your form 499r 2 w 2pr esigned without leaving your Gmail account Go to the Chrome Web Store and add the signNow extension to your browser Log in to your account Open the email you received with the documents that need signing. The Puerto Rico Treasury Department issued the Publication 1704 including the new electronic filing requirements for Forms 499R2/W2PR for 17 What’s new a box was added to include the disaster assistance qualified payments according to Administrative Determination 1721.

INSTRUCTIONS FOR THE EMPLOYEE A COPY MUST BE SUBMITTED WITH YOUR RETURN incorrect, inform this to your employer and request a Form 499R2c/W2cPR Keep copy of this form for your records You can use it to prove your right to social security benefits If your name, address or social security number is prosecution eight years. No puede mostrar la información de los formularios 499R2/W2PR Sin embargo, puede mostrar la misma información en el reporte de Resumen de Empleados Cargue los formularios 499R2/W2PR en su impresora Si tiene más de un año de datos, seleccione el año para el que desee imprimir los formularios. How SSA Processes Wage Reports Employers send paper Forms 499R2/W2PR wage reports to the SSA Direct Operations Center in WILKESBARRE, PENNSYLVANIA, under cover of Form W3PR The full address is clearly shown on the Form 499R2/W2PR and also on the W3PR instructions This center screens the wage reports for legibility and timeliness.

You can view the instructions for filling out a 499R2/w2PR online Employer instructions I was trying unsuccessfully to find a copy of the actual form since it is obviously different from the one we get in the continental US. Form 499R2/W2PR, including all information reported Complete the electronic transfer before the due date in order to avoid late filing penalties Email address is required at RA record, location Reimbursed Expenses includes Fringe Benefits (RS State Record, location ) and (RV State Total Record, location 3347). How do I enter WPR?.

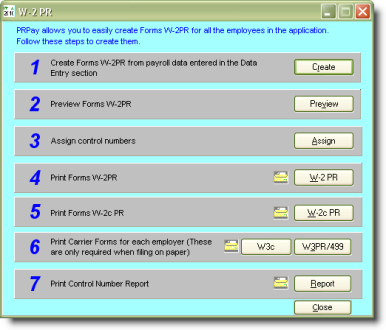

You will be penalized by the Department of the Treasury. To print a 499R2/W2PR form From the Reports menu, choose Payroll, then choose Print 499R2/W2PR Forms You cannot display 499R2/W2PR information However, you can display the same information in the yeartodate Employee Summary report. Now includes instructions on payments Indicate if the remuneration includes payments to the employee for (a) Services rendered by a qualified physician under Act 1417;.

How SSA Processes Wage Reports Employers send paper Forms 499R2/W2PR wage reports to the SSA Direct Operations Center in WILKESBARRE, PENNSYLVANIA, under cover of Form W3PR The full address is clearly shown on the Form 499R2/W2PR and also on the W3PR instructions This center screens the wage reports for legibility and timeliness. Verify each Form 499R2/W2PR has a printed control number The control number must be entered in the "Control Number" field, location in the State Record (Code RS record) The number sequence from to were not used since the same is reserved for the Department’s purposes only, as instructed in this publication. You can view the instructions for filling out a 499R2/w2PR online Employer instructions I was trying unsuccessfully to find a copy of the actual form since it is obviously different from the one we get in the continental US.

Instructions for filing Form 499R2/W2PR Copy A (W2) information to the Department of the Treasury through electronic transfer using the MMW2PR1 format Who must use these instructions?. 499R2/W2PR, including all information reported Verify that the correct tax year is entered in the Code RE record (Employer Record), location 36 Verify the complete name and address of the employee is entered in the Code RW record (Employee Wage Record), locations 12 to 142. And (c) Others “Filing Date” and “Year” boxes are formatted differently in 18 version.

Form 499R2/W2PR, including all information reported Complete the electronic transfer before the due date in order to avoid late filing penalties Email address is required at RA record, location Reimbursed Expenses includes Fringe Benefits (RS State Record, location ) and (RV State Total Record, location 3347). The format is different than a regular W2 and I do not know how to enter in the information. Puede radicar electrónicamente los Formularios W3PR junto con los Formularios 499R2/W2PR en el sitio web de la SSA en Employer W2 Filing Instructions & Information (Instrucciones e información para patronos sobre la radicación de Formularios W2), disponible en inglés Puede crear versiones rellenables de.

499R2/W2PR, including all information reported Verify that the correct tax year is entered in the Code RE record (Employer Record), location 36 Verify the complete name and address of the employee is entered in the Code RW record (Employee Wage Record), locations 12 to 142. Instructions for filing Form 499R2c/W2cPR (W2c) information to the Department of the Treasury via electronic filing using the EFW2CPR format Who must use these instructions?. Para ver las instrucciones de cómo completar el comprobante de retención 499R2/W2PR, hacer clic aquí Para ver las instrucciones de cómo corregir un Formulario 499R2/W2PR ya sometido al Departamento, utilizando el Formulario 499R2c/W2cPR "Corrección al Comprobante de Retención", hacer clic aquí.

Instructions for filing Form 499R2/W2PR Copy A (W2) information to the Department of the Treasury through electronic transfer using the MMW2PR1 format Who must use these instructions?. Rate 499r 2 W 2pr as 5 stars Rate 499r 2 W 2pr as 4 stars Rate 499r 2 W 2pr as 3 stars Rate 499r 2 W 2pr as 2 stars Rate 499r 2 W 2pr as 1 stars 23 votes Create this form in 5 minutes or less Get Form Follow the stepbystep instructions below to esign your publication 18 03 Select the document you want to sign and click Upload. Verify each Form 499R2/W2PR has a printed control number The control number must be entered in the "Control Number" field, location in the State Record (Code RS record) The number sequence from to were not used since the same is reserved for the Department’s purposes only, as instructed in this publication.

Instructions for filing Form 499R2/W2PR Copy A (W2) information to the Department of the Treasury on magnetic media using the MMW2PR1 format Who must use these instructions?. To request an extension of time to file the Withholding Statement (W2PR) and Reconciliation Statement of Income Tax Withheld (499R3) submit an electronic filing of Form AS 2727 The electronic application will be available through SURI Filings in paper form, via fax, mail or any other method will not be considered as filed. Your situation requires you to file two returns a Puerto Rico return and a US return.

INSTRUCTIONS FOR THE EMPLOYEE A COPY MUST BE SUBMITTED WITH YOUR RETURN incorrect, inform this to your employer and request a Form 499R2c/W2cPR Keep copy of this form for your records You can use it to prove your right to social security benefits If your name, address or social security number is prosecution eight years. Employers with 5 or more W 2 Forms to submit What if I have 5 or more W 2s and I send you paper W 2s?. Form 499R2/W2PR (Withholding Statement) This withholding statement is the Puerto Rico equivalent of the US Form W2 and should be prepared for every employee The form comes in five copies.

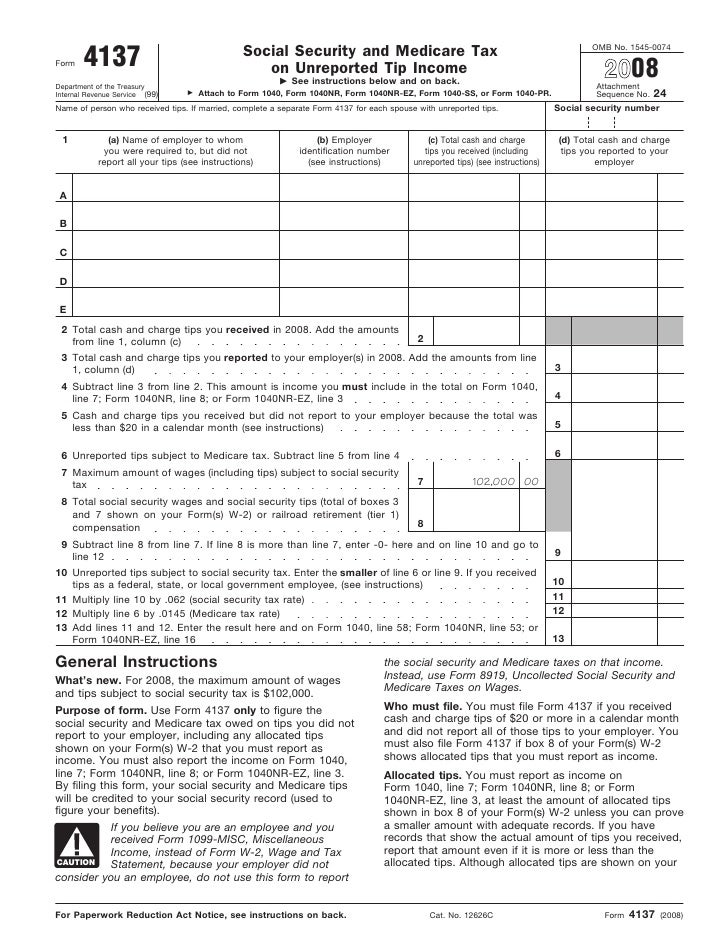

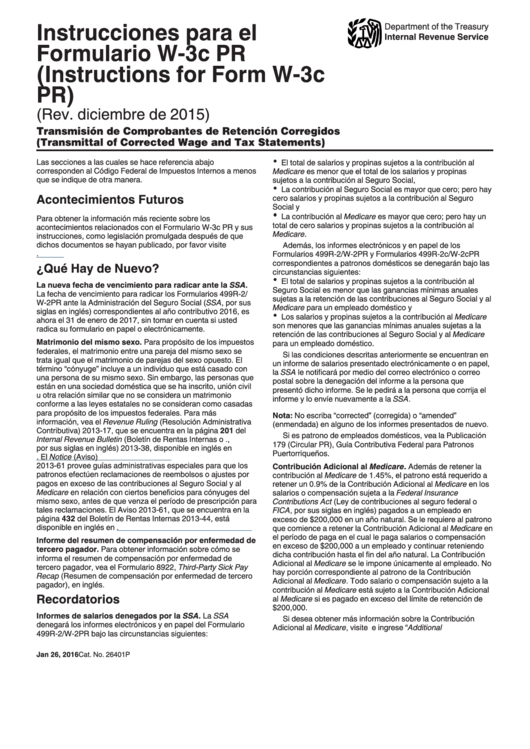

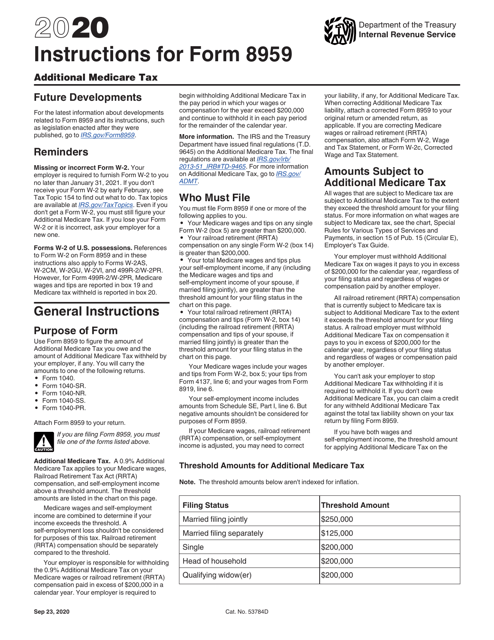

Modified fields The 19 Form 499R2/PR W2PR added Boxes C and D to report services rendered in agricultural labor (Box C) and services rendered by a minister of a church or religious order (Box D) Control Numbers The Puerto Rico Treasury Department has reserved the sequence between and for internal use. Employers who have filed a W2 Form with a private program and have to correct the same. Instructions also apply to Forms W2AS, W2CM, W2GU, W2VI, and 499R2/W2PR However, for Form 499R2/W2PR, Medicare wages and tips are reported in box 19 and Medicare tax withheld is reported in box General Instructions Purpose of Form Use Form 59 to figure the amount of Additional Medicare Tax you owe and the.

The W2PR section of the Print Preview menu allows you to create, preview, and print Forms W2PR, and create the 499R, the W3, and the Control Number reports To automatically create these files, PRPay retrieves the information from the Companies, Employees and Payrolls modules. Employers with 5 or more W 2 Forms to submit What if I have 5 or more W 2s and I send you paper W 2s?. Para ver las instrucciones de cómo completar el comprobante de retención 499R2/W2PR, hacer clic aquí Para ver las instrucciones de cómo corregir un Formulario 499R2/W2PR ya sometido al Departamento, utilizando el Formulario 499R2c/W2cPR "Corrección al Comprobante de Retención", hacer clic aquí.

Http Www Hacienda Gobierno Pr Sites Default Files Publicaciones 16 12 Publication 16 04 Pdf

Http Www Hacienda Gobierno Pr Sites Default Files Publicaciones 18 11 Publication 18 03 Pdf

Irs W 3pr Instruction Pdffiller

3 21 3 Individual Income Tax Returns Internal Revenue Service

Electronic Filing Requirements For Forms 499r 2 W 2pr Grant Thornton

Fillable Online Form 499r 2 W 2pr Fax Email Print Pdffiller

Creating Electronic Files

Instrucciones Para El Anexo H Pr Formulario 1040 Pr Pdf Free Download

Form 4137 Social Security And Medicare Tax On Unreported Tip Income

Ye10us9e

Irs Form W 3pr Download Printable Pdf Or Fill Online Transmittal Of Withholding Statements English Puerto Rican Spanish Templateroller

Http Hacienda Gobierno Pr Downloads Software Manualw203 Eng Pdf

Form 499r 2 W 2pr Comprobante De Retencion Withholding Statement Puerto Rico Department Of The Treasury Printable Pdf Download

Http Www Hacienda Pr Gov Sites Default Files Publicaciones 19 10 Publication 19 02 Pdf

12 Form 1040 Ss Internal Revenue Service

Www Ssa Gov Employer Efw 19efw2 Pdf

Irs W 3pr Instruction Pdffiller

2

2

Http Www Hacienda Pr Gov Sites Default Files Publicaciones 12 Publication 01 1 Pdf

Instrucciones Para El Formulario W 3c Pr Instructions For Form W 3c Pr Rev Diciembre De 15 Printable Pdf Download

Www Reginfo Gov Public Do Downloaddocument Objectid

Tax Guide Puerto Rico

Http Www Hacienda Gobierno Pr Sites Default Files Publicaciones 16 12 Publication 16 04 Pdf

Http Hacienda Pr Gov Sites Default Files Procedimientos Y Requisitos Comprobante Ingles Pdf

Download Instructions For Irs Form 59 Additional Medicare Tax Pdf Templateroller

3 21 3 Individual Income Tax Returns Internal Revenue Service

Irs 17 Instructions For Form 59 Pdf 17 Department Of The Treasury Internal Revenue Service Instructions For Form 59 Additional Medicare Tax Course Hero

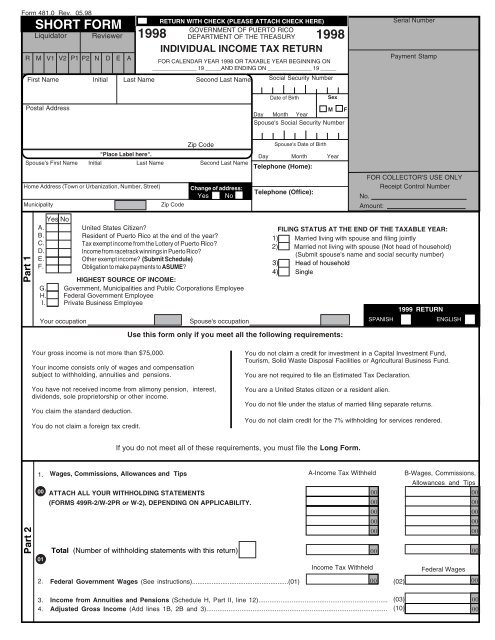

Short Form 1998 Departamento De Hacienda

Form 499r 2 W 2pr Copy A Electronic Filing Requirements For Tax Year 16

Form 499r 2 W 2pr Comprobante De Retencion Withholding Statement Puerto Rico Department Of The Treasury Printable Pdf Download

Http Www Hacienda Pr Gov Sites Default Files Publicaciones 14 11 Publication 14 04 Pdf

Fill Free Fillable Form 4137 19 Unreported Tip Income Pdf Form

Miperfil Colegiocpa Com Download Php Id

19 Electronic Filing Requirements For Form 499r 2 W 2pr Grant Thornton

Form 499r 2 W 2pr Copy A Electronic Filing Requirements For Tax Year 16

Long Form Departamento De Hacienda

Eformrs Com Forms09 Fedpdf09 4137 Pdf

3 21 3 Individual Income Tax Returns Internal Revenue Service

W 2pr Fill Online Printable Fillable Blank Pdffiller

19 Electronic Filing Requirements For Form 499r 2 W 2pr Grant Thornton

Instrucciones Para El Anexo H Pr Internal Revenue Service

2

Http Www Hacienda Pr Gov Sites Default Files Publicaciones 17 12 Publication 17 04 Pdf

Www Grantthornton Pr Globalassets 1 Member Firms Puerto Rico Publications Professional Articles 19 Articles Pdf 10 23 19 Outsourcing Article Electronic Filinf Requierements For Form 499r 2w 2pr Pdf

Instrucciones Para El Anexo H Pr Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Irs W 3pr Instruction Pdffiller

Fillable Online W 3pr 12 Form Fax Email Print Pdffiller

2

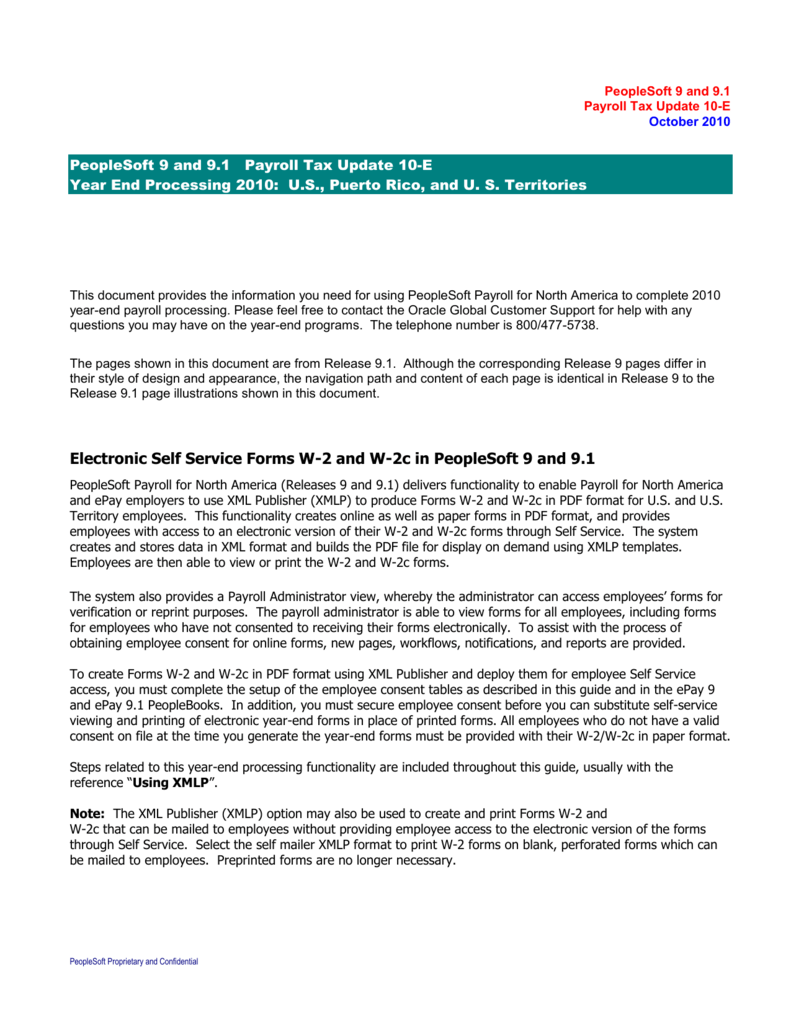

09 Year End Processing Irs Tax Forms Tax Deduction

Form W 3 Pr Informe De Comprobantes De Retencion Transmittal Of Wi

Www Irs Gov Pub Irs Prior Fw3pr Pdf

Efw2 Tax Year 10 Social Security

2

Caution Draft Not For Filing Pdf Free Download

Internal Revenue Bulletin 18 29 Internal Revenue Service

Formulario W 2pr W 2c Para Formulario De Presentaci Oacute N Electr Oacute Nica W2pr En L Iacute Nea Software W2pr

Form 499r 2 W 2pr Copy A Electronic Filing Requirements For Tax Year 16

Form 1040 Ss U S Self Employment Tax Return Form 14 Free Download

What Is Irs Form 59 How To File It A Illustrated Guide

2

Http Www Hacienda Pr Gov Sites Default Files Publicaciones 17 12 Publication 17 04 Pdf

W 2 Pr

Form W 3 Pr Informe De Comprobantes De Retencion

Http Www Hacienda Gobierno Pr Sites Default Files Publicaciones Publication 13 05 Pdf

Form 1040 Ss U S Self Employment Tax Return Including The Additional Child Tax Credit For Bona Fide Residents Of Puerto Rico

Visionms Net W2showto18 Pdf

3 21 3 Individual Income Tax Returns Internal Revenue Service

Form As Request For Extension Of Time To File The Withholding Statement 499r 2 W 2pr And The Reconciliation Statement Of Income Tax Withheld 499 R 3 14 Printable Pdf Download

499 R 3 Fill Online Printable Fillable Blank Pdffiller

Http Hacienda Gobierno Pr Downloads Software Manualw203 Eng Pdf

Form W 3 Pr Informe De Comprobantes De Retencion Info Copy Only

499r 2 W 2pr Fill Out And Sign Printable Pdf Template Signnow

3 21 3 Individual Income Tax Returns Internal Revenue Service

Irs W 3pr Pdffiller

Visionms Net W2showto18 Pdf

Http Hacienda Gobierno Pr Sites Default Files Publicaciones 19 10 Publication 19 01 Pdf

3 21 3 Individual Income Tax Returns Internal Revenue Service

Http Www Hacienda Pr Gov Sites Default Files Documentos Shortform03 Pdf

Instruction W3 Pr Rev 03 Internal Revenue Service

Download Instructions For Irs Form 59 Additional Medicare Tax Pdf Templateroller

Http Www Hacienda Pr Gov Sites Default Files Publicaciones 19 10 Publication 19 02 Pdf

2

Http Www Hacienda Gobierno Pr Sites Default Files Publicaciones 17 01 Publication 16 05 Pdf

Http Www Hacienda Gobierno Pr Sites Default Files Publicaciones 17 01 Publication 16 05 Pdf

Http Www Hacienda Pr Gov Sites Default Files Publicaciones 12 Publication 01 1 Pdf

Fill Free Fillable Form W 3pr Informe De Comprobantes De Retencion 17 Pdf Form

Www Ssa Gov Employer Efw 18efw2 Pdf

Download Instrucciones Para Irs Formulario W 3pr Informe De Comprobantes De Retencion Pdf Templateroller

Irs 17 Instructions For Form 59 Pdf 17 Department Of The Treasury Internal Revenue Service Instructions For Form 59 Additional Medicare Tax Course Hero

2

What Is Irs Form 59 How To File It A Illustrated Guide

Caution Draft Not For Filing Pdf Free Download