I 179

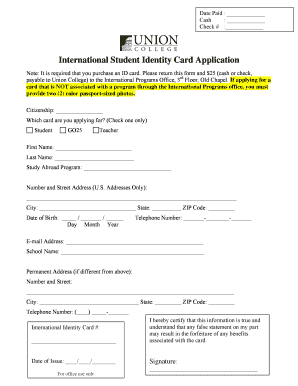

Free Wedding Home Cliparts Download Free Clip Art Free Clip Art On Clipart Library

D Nb Info 34

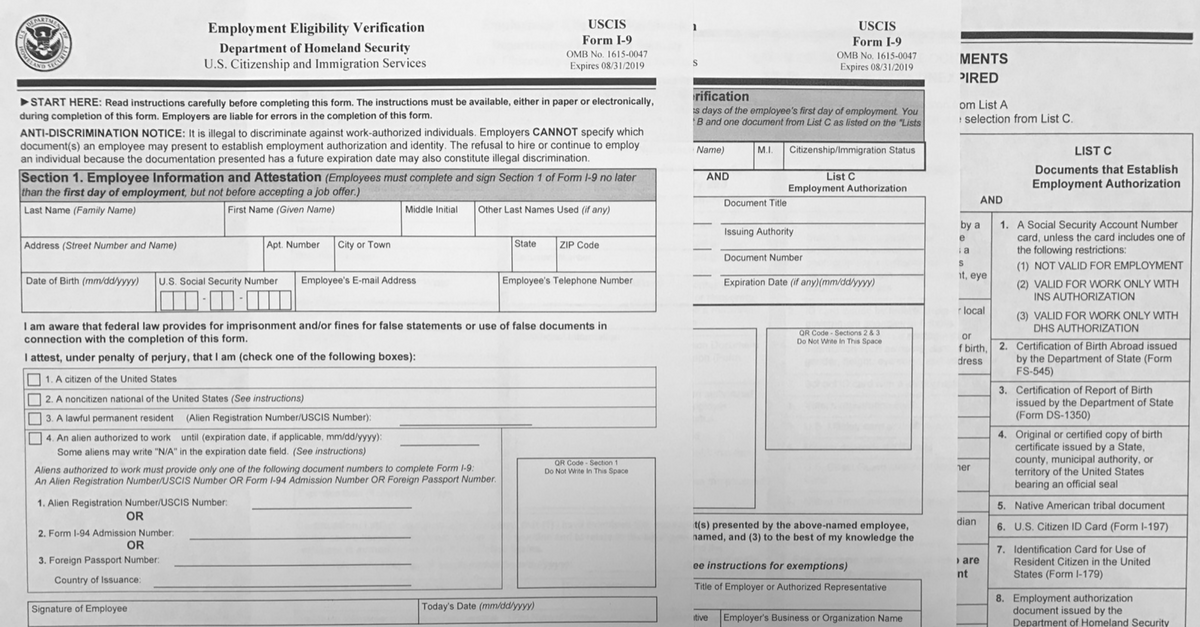

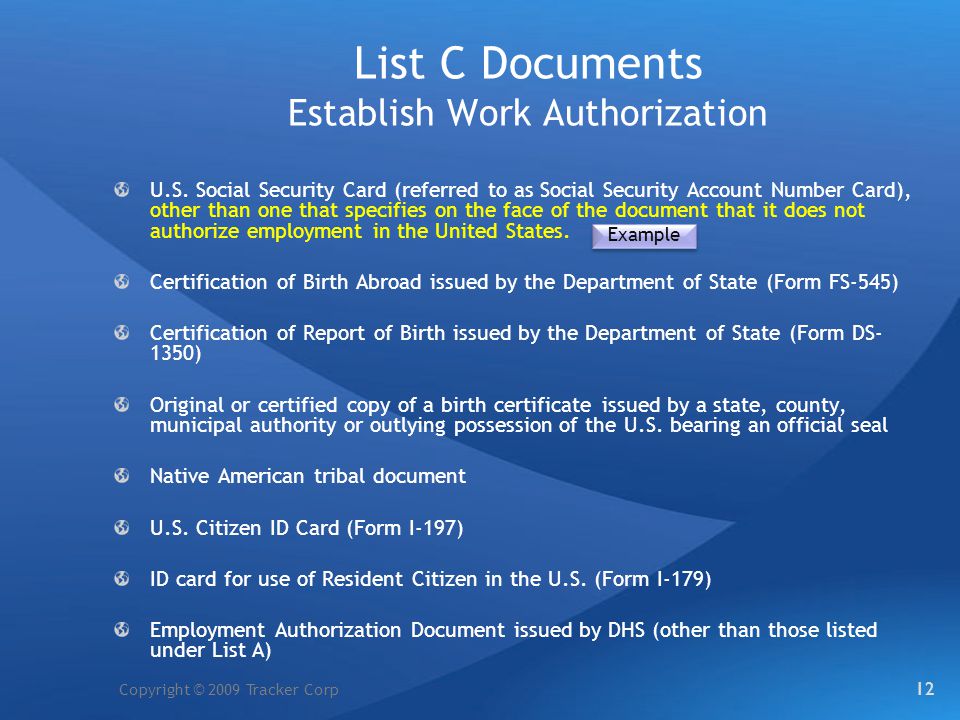

Form I 9 Completion Training Ppt Download

Form I 9 Acceptable Documents Uscis

The Project Gutenberg Ebook Of Anecdotes Of Animals By Various

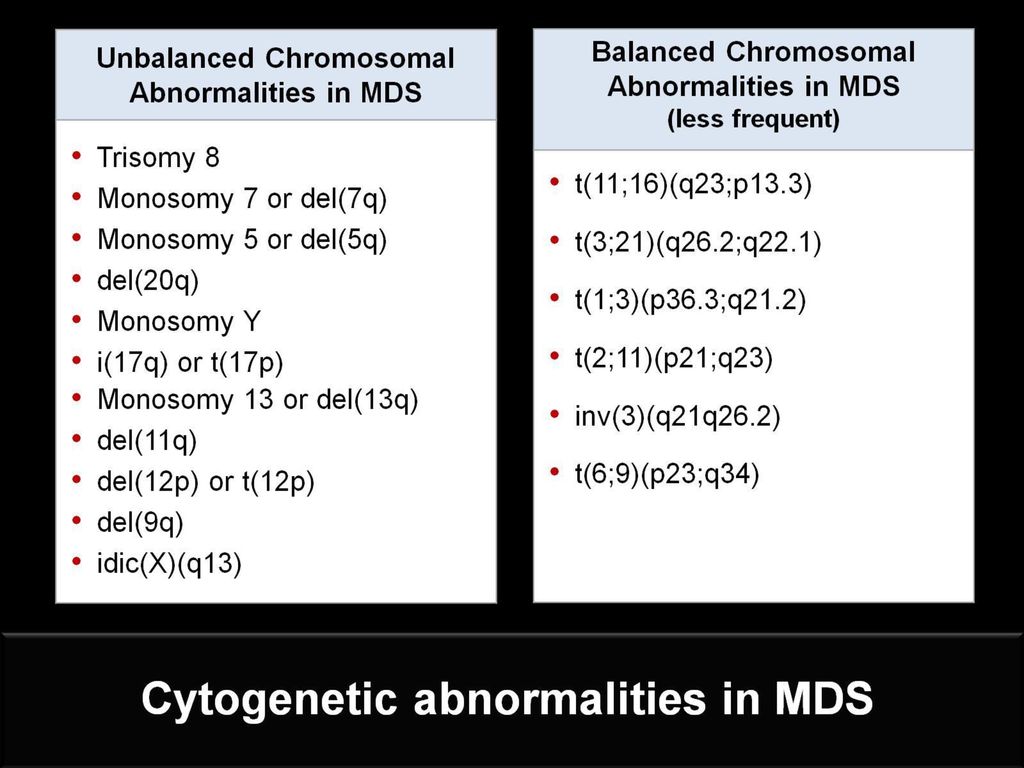

Ipss R Classification Of Mds Download Table

Instead of depreciating an asset over a multiyear period, you might be able to deduct its entire cost during the first year of use This is called a Section 179 deduction, also (erroneously) called Section 179 depreciation Think of it as instant gratification when it comes to deducting the cost of a newlypurchased business asset.

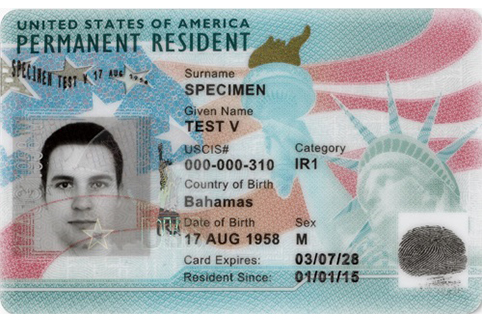

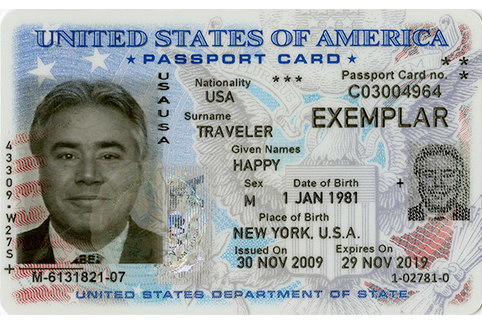

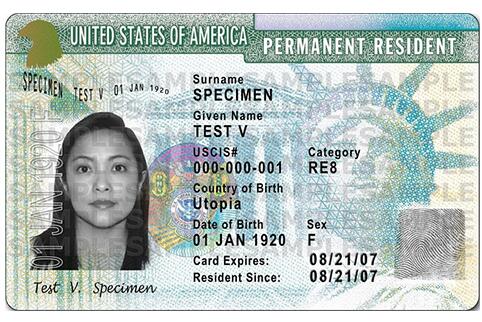

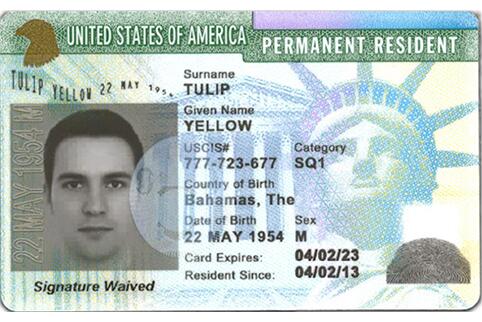

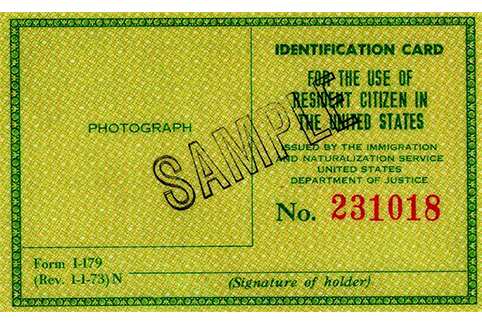

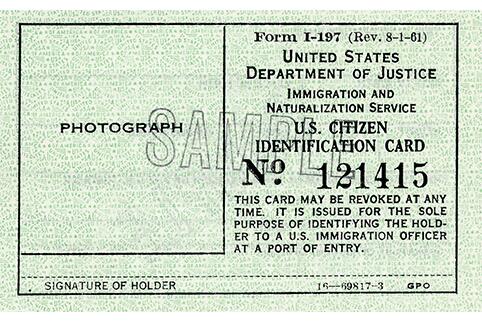

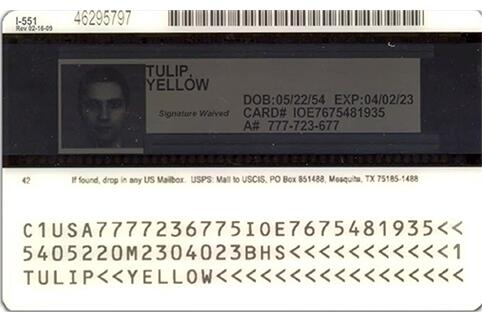

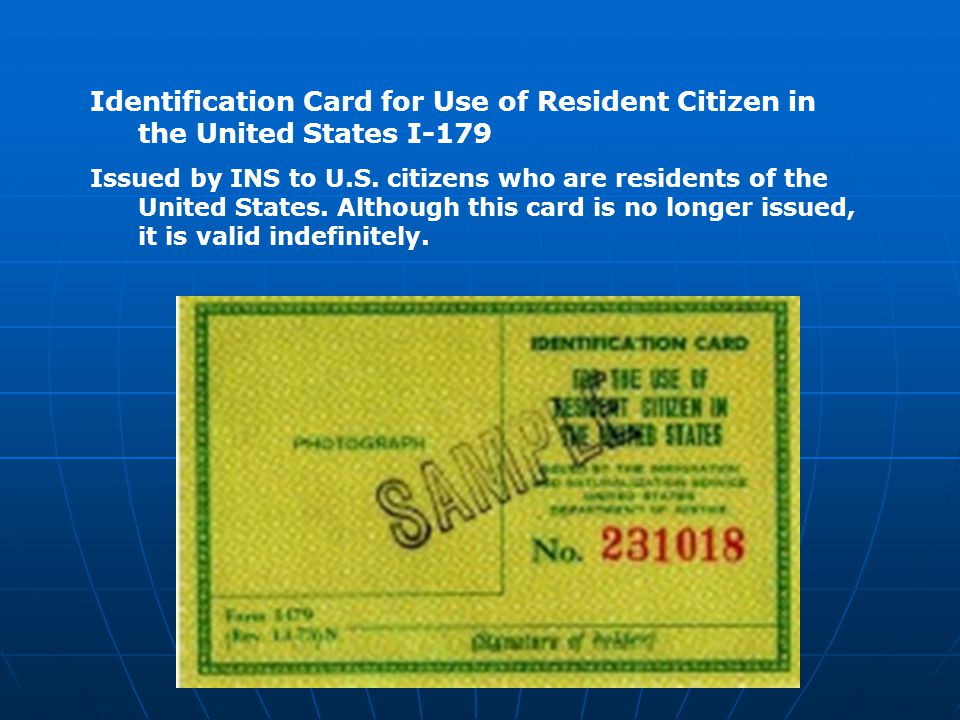

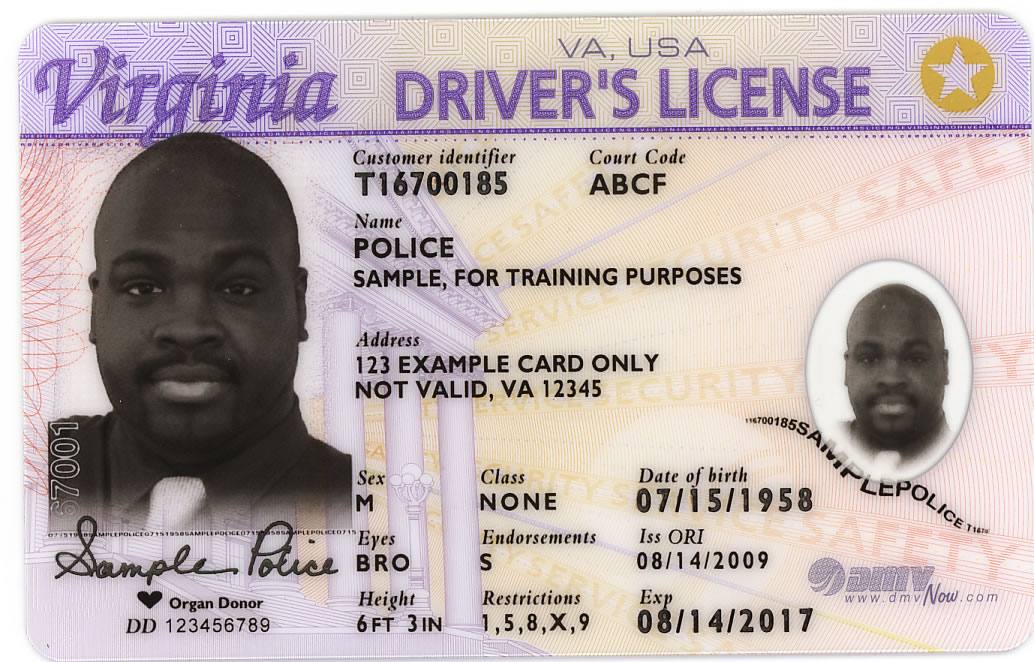

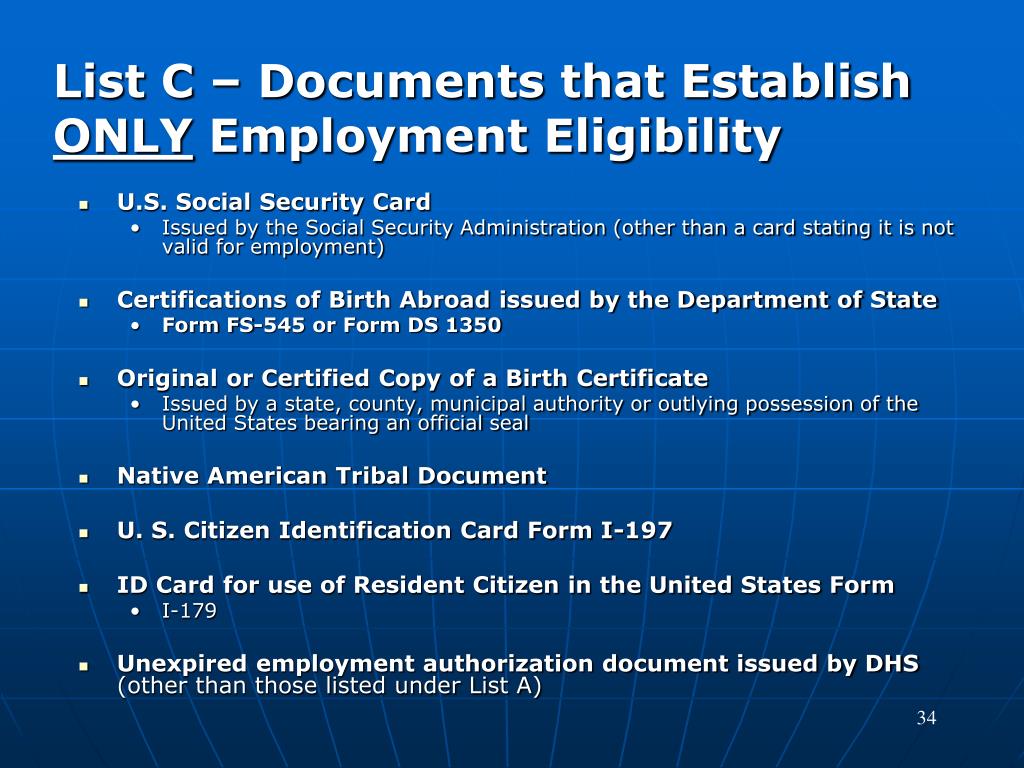

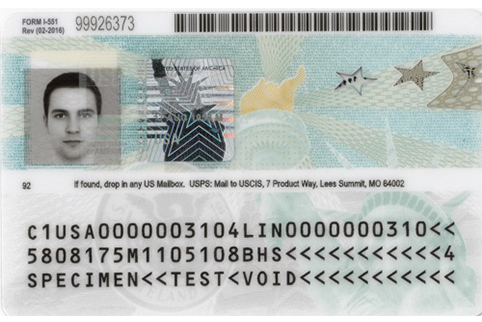

I 179. Details about Hand keys bencher rj series i179show original title See original listing Hand keys bencher rj series i179 Condition New Ended Jan 22, 21 Starting bid EUR 100 Approximately US $144 (including shipping) 0 bids Shipping EUR 4500 (approx US $5433). US citizen Identification card (I 179 or I 197) ☐ Permanent Resident card (I 551) ☐ MachineReadable Immigrant Visa (MRIV) with temporary I551 language and Alien Documentation, Identification and Telecommunications System (ADIT) stamp ☐ Employment Authorization card “EAD” (I766) ☐ Advance parole document with photo (I 512 or I. Form I179, Identification Card for Use of Resident Citizen in the United States INS issued Forms I179 to US citizens who are residents of the United States This card does not contain an expiration date, and is valid indefinitely Form I179, Identification Card for Use of Resident Citizen in the United States.

The election under section 179 and § to claim a section 179 expense deduction for section 179 property shall be made on the taxpayer 's first income tax return for the taxable year to which the election applies (whether or not the return is timely) or on an amended return filed within the time prescribed by law (including extensions) for filing the return for such taxable year. Section 179, or Internal Revenue Code Section 179 is a type of tax deduction that allows small and medium businesses to deduct property or equipment expenses, up to $1 million as of 18. Therefore, please consult your tax professional to confirm vehicle depreciation deduction and tax benefits.

The election under section 179 and § to claim a section 179 expense deduction for section 179 property shall be made on the taxpayer 's first income tax return for the taxable year to which the election applies (whether or not the return is timely) or on an amended return filed within the time prescribed by law (including extensions) for filing the return for such taxable year. INS issued Form I179 and I197 to naturalized US citizens living near the Canadian or Mexican border who needed it for frequent border crossings Although neither form is currently issued, either form that was previously issued is still valid. Another method of deducting the cost of a heavy vehicle is using Section 179 Section 179 allows business owners to deduct $1 million in personal property they buy for their business each year However, the Section 179 deduction is limited to $25,000 for trucks and SUVs.

Check out the deal on I179 Lg Candle Slice at StampsByJudithcom. I have a handful of vehicles that were fully taken under Section 179 for taxes, the result is a $0 Depreciation basis for tax purposes No, it means that the book value of the asset is zero Cost and depreciation are equal when you took section 179 accelerated depreciation you should have entered it on the books. For the best answers, search on this site https//shorturlim/M546K You should visit your local office and apply for a new card (Be sure to bring two forms of ID, one should be a photo ID) Once you have applied in person for the new card, you will get a printout stating your social security number, your full legal name and denoting that you have applied for a new card.

I have a handful of vehicles that were fully taken under Section 179 for taxes, the result is a $0 Depreciation basis for tax purposes No, it means that the book value of the asset is zero Cost and depreciation are equal when you took section 179 accelerated depreciation you should have entered it on the books. Another method of deducting the cost of a heavy vehicle is using Section 179 Section 179 allows business owners to deduct $1 million in personal property they buy for their business each year However, the Section 179 deduction is limited to $25,000 for trucks and SUVs. Form used in conjunction with your visa to establish temporary OR permanent residence in the US Only available from the United States Citizen and Immigration Services.

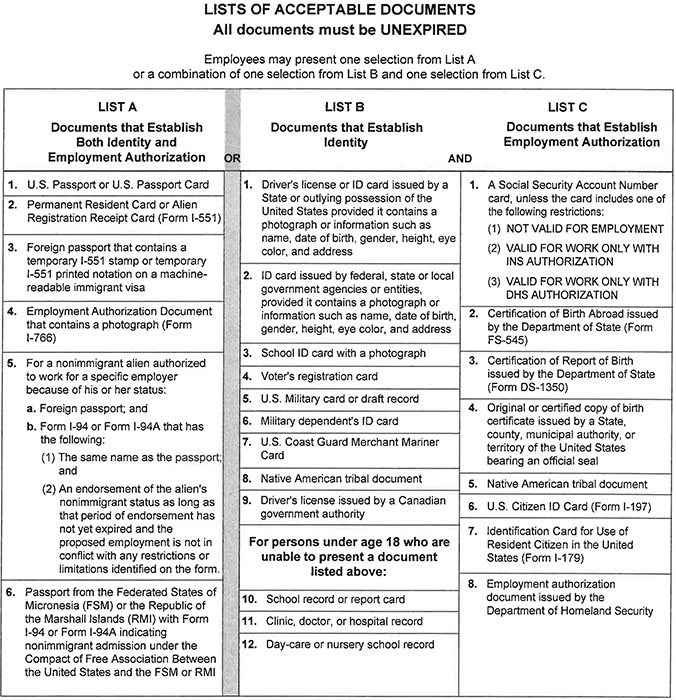

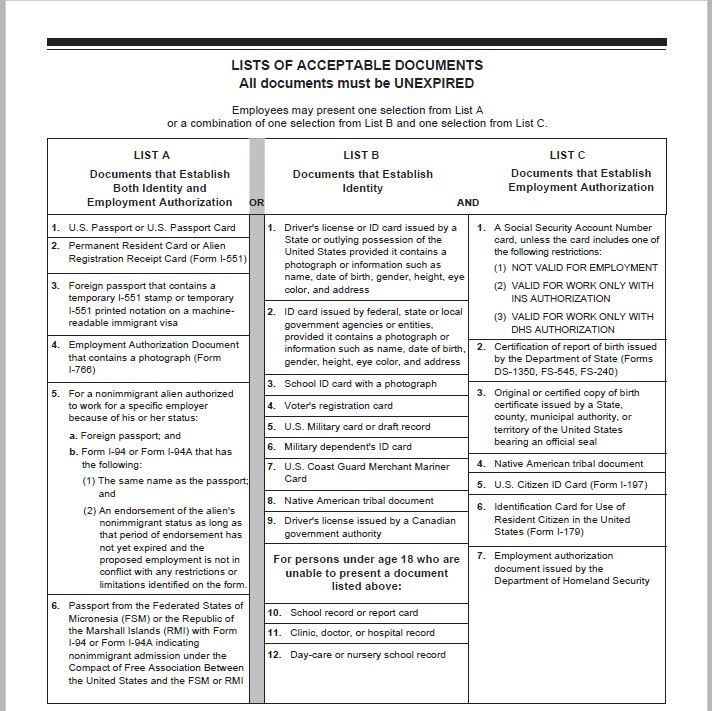

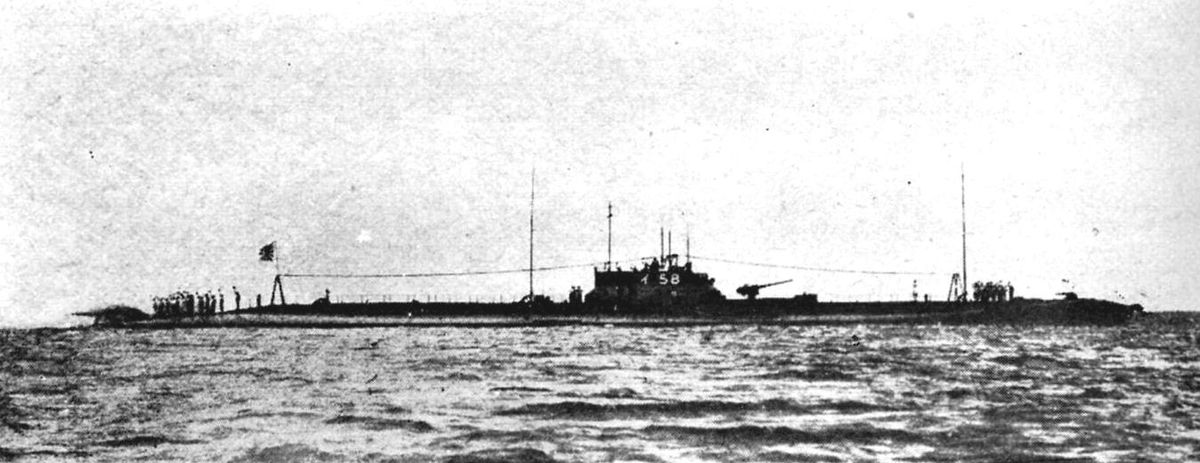

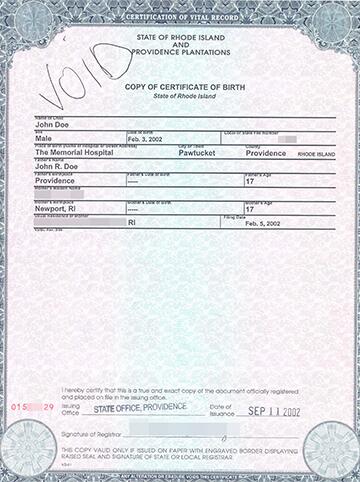

Identification Card for Use of Resident Citizen in the US (Form I179) Some Things to Check As You Examine Documents Make sure the applicant's status as they have listed it in Section I matches the identification documents All documents must be originals, not copies Copies of documents are not acceptable. Check out the deal on I179 Lg Candle Slice at StampsByJudithcom. The Japanese submarine I179 (originally I79) was a Kaidai type cruiser submarine of the KD7 subclass built for the Imperial Japanese Navy (IJN) during the 1940s She was lost with all hands when a valve was accidentally left open during her sea trials in July 1943 Her wreck was later salvaged and scrapped in 1957.

Section 179 allows taxpayers to deduct the cost of certain property as an expense when the property is placed in service For tax years beginning after 17, the TCJA increased the maximum Section 179 expense deduction from $500,000 to $1 million The phaseout limit increased from $2 million to $25 million. Question I am planning to buy a $113,000 motor home and use Section 179 to expense the entire $113,000 My plan for this year is to use the motor home in my dental practice for two trips to national conventions. What Is Section 179 Deduction?.

A rescue vessel from Kure locates the wreck of I179 in 265 feet of water in 3229N, E The divers discover that several hatches in the bow area, as well as the bow buoyancy tank vent valve, are left open The subsequent inquiry. With asset depreciation your business saves on taxes if you own property, equipment, vehicles, or fixtures that can be claimed with Section 179 deductions. Section 179 Deduction Non Qualifying Property While most equipment that small businesses lease, finance or purchase will qualify for the Section 179 Deduction, there are some exceptions Although we provide a basic list below, it cannot cover everything.

SUVs, trucks, vans, and other vehicles that don’t qualify as passenger vehicles aren’t subject to the IRS limits You can take a full depreciation deduction each year Using bonus depreciation and Section 179, you may be able to deduct all or most of the cost of such a vehicle in a single year. Question I am planning to buy a $113,000 motor home and use Section 179 to expense the entire $113,000 My plan for this year is to use the motor home in my dental practice for two trips to national conventions. Form used in conjunction with your visa to establish temporary OR permanent residence in the US Only available from the United States Citizen and Immigration Services.

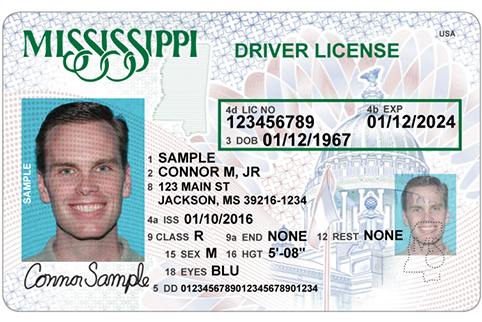

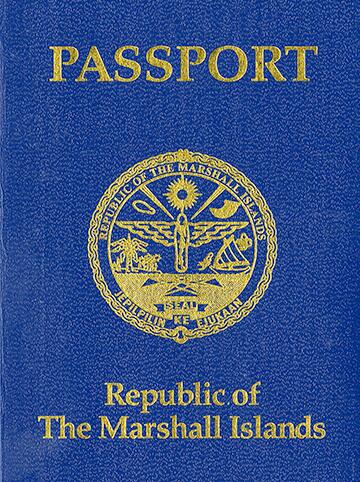

Section 179 expensing allows you to fully expense all, or a portion of, your purchased assets in a single tax year, instead of capitalizing and deducting through deprecation over a number of years The Tax Cuts and Jobs Act altered the section 179 expensing rules. 700 Island Retreat Rd # I179, Port Aransas, TX is currently not for sale The 878 sq ft condo is a bed, bath unit This condo was built in 1978 and last sold on for View more property details, sales history and Zestimate data on Zillow. States (Form I179) 9 Driver's license issued by a Canadian government authority For persons under age 18 who are unable to present a document listed above 7 Employment authorization document issued by the Department of Homeland Security 6 Passport from the Federated States of Micronesia (FSM) or the Republic of the Marshall Islands (RMI) with.

Bonus depreciation is a tax incentive that allows small to midsized businesses to take a first yeardeduction on purchases of qualified business property in addition to other depreciation The Section 179 deduction is also a tax incentive for businesses that purchase and use qualified business property, but the two are not the same. States (Form I179) 9 Driver's license issued by a Canadian government authority For persons under age 18 who are unable to present a document listed above 7 Employment authorization document issued by the Department of Homeland Security 6 Passport from the Federated States of Micronesia (FSM) or the Republic of the Marshall Islands (RMI) with. With asset depreciation your business saves on taxes if you own property, equipment, vehicles, or fixtures that can be claimed with Section 179 deductions.

SECTION 179 DEDUCTION 1 Each individual's tax situation is unique;. You must claim Section 179 deductions for equipment in the tax year that the equipment was "placed in service" meaning when the boat is ready and available Please be advised If you chose not to take the full Section 179 deduction, you may be able to take a onetime special allowance depreciation. 01 Modifications to § 179 (1) Section 179(a) allows a taxpayer to elect to treat the cost (or a portion of the cost) of any § 179 property as an expense for the taxable year in which the taxpayer.

INS issued the I179 from 1960 until 1973 It revised the form and renumbered it as Form I197 INS issued the I197 from 1973 until April 7, 19 INS issued Form I179 and I197 to naturalized US citizens living near the Canadian or Mexican border who needed it for frequent border crossings. The Japanese submarine I179 (originally I79) was a Kaidai type cruiser submarine of the KD7 subclass built for the Imperial Japanese Navy (IJN) during the 1940s She was lost with all hands when a valve was accidentally left open during her sea trials in July 1943 Her wreck was later salvaged and scrapped in 1957. Section 179 is for purchases that are used for the " active conduct of the taxpayer's trade or business ", and is limited by the total "Trade or Business" income However, rentals are not always a "Trade or Business".

SUVs, trucks, vans, and other vehicles that don’t qualify as passenger vehicles aren’t subject to the IRS limits You can take a full depreciation deduction each year Using bonus depreciation and Section 179, you may be able to deduct all or most of the cost of such a vehicle in a single year. Section 179 allows taxpayers to deduct the cost of certain property as an expense when the property is placed in service For tax years beginning after 17, the TCJA increased the maximum Section 179 expense deduction from $500,000 to $1 million The phaseout limit increased from $2 million to $25 million. US Dept of Justice – INS US Citizenship Identification Card (I197 or I179) Northern Mariana Card (I873) US passport book that does not indicate on the last page that "THE BEARER IS A UNITED STATES NATIONAL AND NOT A UNITED STATES CITIZEN" US passport card US National.

Essentially, Section 179 allows businesses to deduct the full purchase price of qualifying equipment or property acquired during the current tax year This means that if you buy qualifying equipment in 18, you can deduct the FULL PURCHASE PRICE from your gross business income. CMS I, 179, is the largest (Creto)Mycenaean signet ring ever found It was unearthed at the lower town of Tiryns in December 1915 by Apostolos Arvanitopoulos A type IV golden ring (thick reedhammered roll), with a bezel diameter of 3,5 by 5,7 cm, deeply engraved Its double roll annulus bears three convex belts in relief with two smooth grooves. Section 179 allows taxpayers to deduct the cost of certain property as an expense when the property is placed in service For tax years beginning after 17, the TCJA increased the maximum Section 179 expense deduction from $500,000 to $1 million The phaseout limit increased from $2 million to $25 million.

In 18, for the first time, individuals can instantly write off qualifying capital purchases Such purchases might include heavy equipment, breeding livestock, and structures (singlepurpose) up to $1 million.

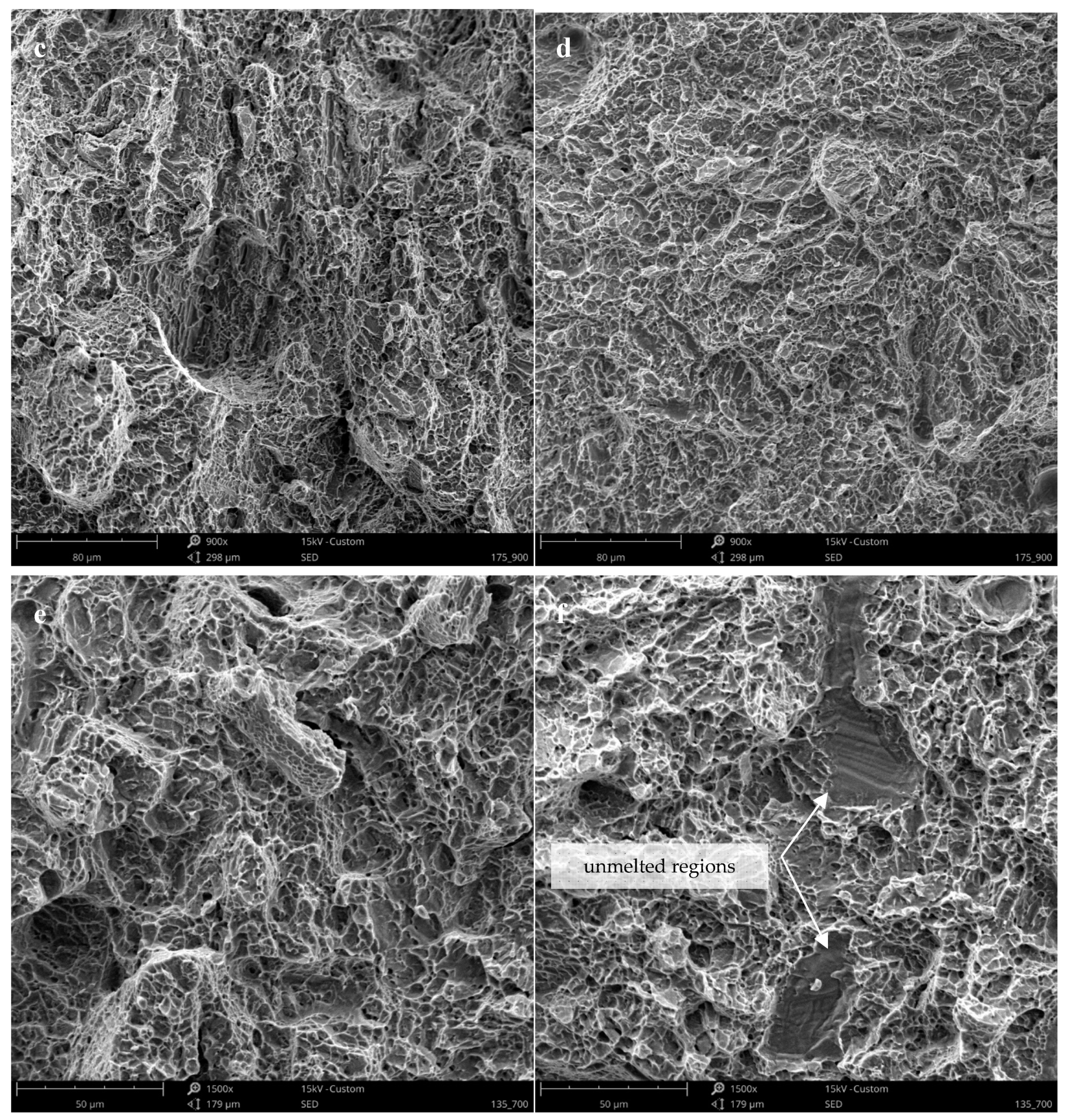

Materials Free Full Text Mechanical Properties And Microstructure Of Dmls Ti6al4v Alloy Dedicated To Biomedical Applications Html

Martha Stewart Collection Essentials Quilted Waterproof Full Mattress Pad I179 Mattress Pads Feather Beds Home Garden Worldenergy Ae

24 Printable High School Resume Template Forms Fillable Samples In Pdf Word To Download Pdffiller

Www Gsa Gov Cdnstatic Doc Acceptableidformsmay514 Pdf

Kofax Express Desktop For Desktop Scanners

Employment Opportunities Student Financial Aid

Form I 9 Acceptable Documents Uscis

Form I 9 Acceptable Documents Uscis

Epos Trade

Relationship Of Morphologic Changes In The Brain And Spinal Cord And Disease Symptoms With Cerebrospinal Fluid Hydrodynamic Changes In Patients With Chiari Malformation Type I Sciencedirect

Www Unmc Edu Hr Forms I 9 Guide Book Pdf

Japanese Submarine I 179 Wikiwand

新员工入职i 9表格填写指南 寿司交流寿司盘在线商铺画盘教学盘饰教学

Table 2 From The 08 Revision Of The World Health Organization Who Classification Of Myeloid Neoplasms And Acute Leukemia Rationale And Important Changes Semantic Scholar

Q Tbn And9gcrniulctfkvaeo2unibr9jl Xd3agyp8v2cdvnvrgela4mpxl4k Usqp Cau

How Do We Complete Form I 9 Section 1 And 2 For A Minor Community Partners Project Handbook

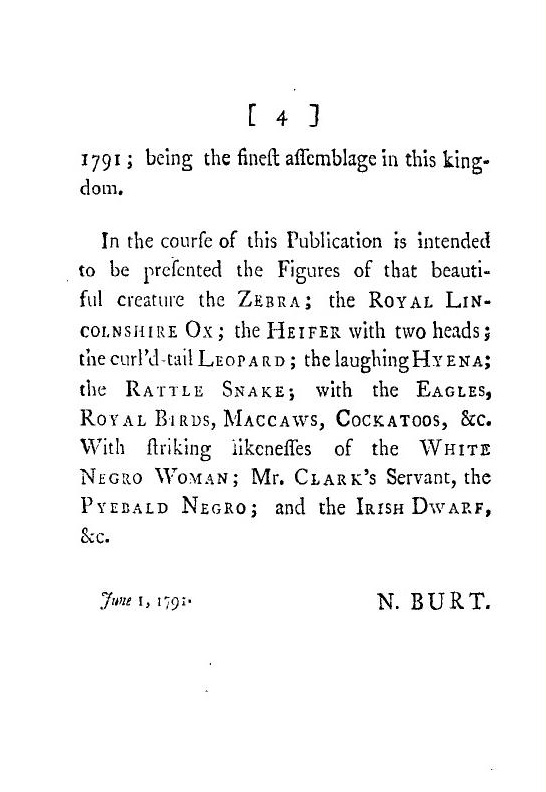

Mrs Newsham The White Negress Graphic Arts

Pdf Profiling Early Humoral Response To Diagnose Novel Coronavirus Disease Covid 19

Form I 9 Acceptable Documents Uscis

Cabinet Des Titres Wikipedia

Www Tandfonline Com Doi Pdf 10 1080 Needaccess True

الشلل الدماغي سرق أجمل لحظات الطفلة سما وتحتاج لعملية تنقذ حياتها مجلة سنابل الأمل الإلكترونية للأشخاص ذوو إعاقة

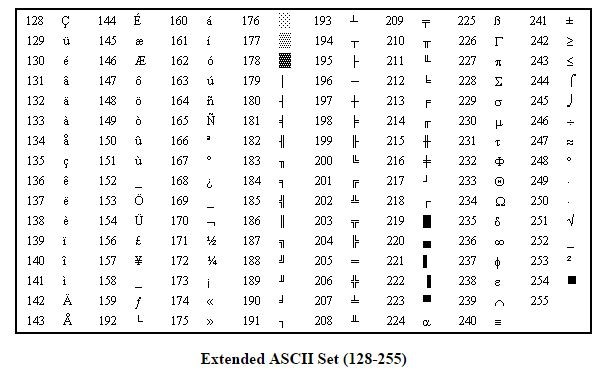

322 Appendix B

Q Tbn And9gcrtp6mjkxo75l 2aqj4lbjsooyf72ahf7u8srcek Iiueykknrn Usqp Cau

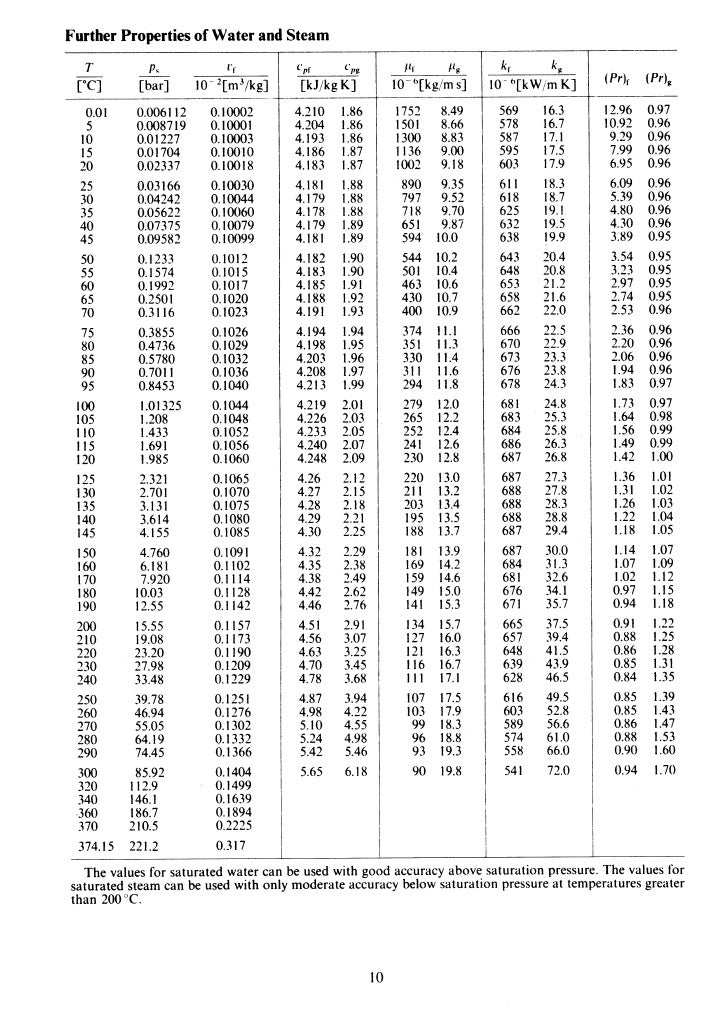

Steam Tables

Troy Smith Dtroysmith Twitter

Afid

Abbreviations Dipss Dynamic International Prognostic Scoring System Download Scientific Diagram

Ajans Icerikleri Sayfa 486 Onedio Sosyal Icerik Platformu

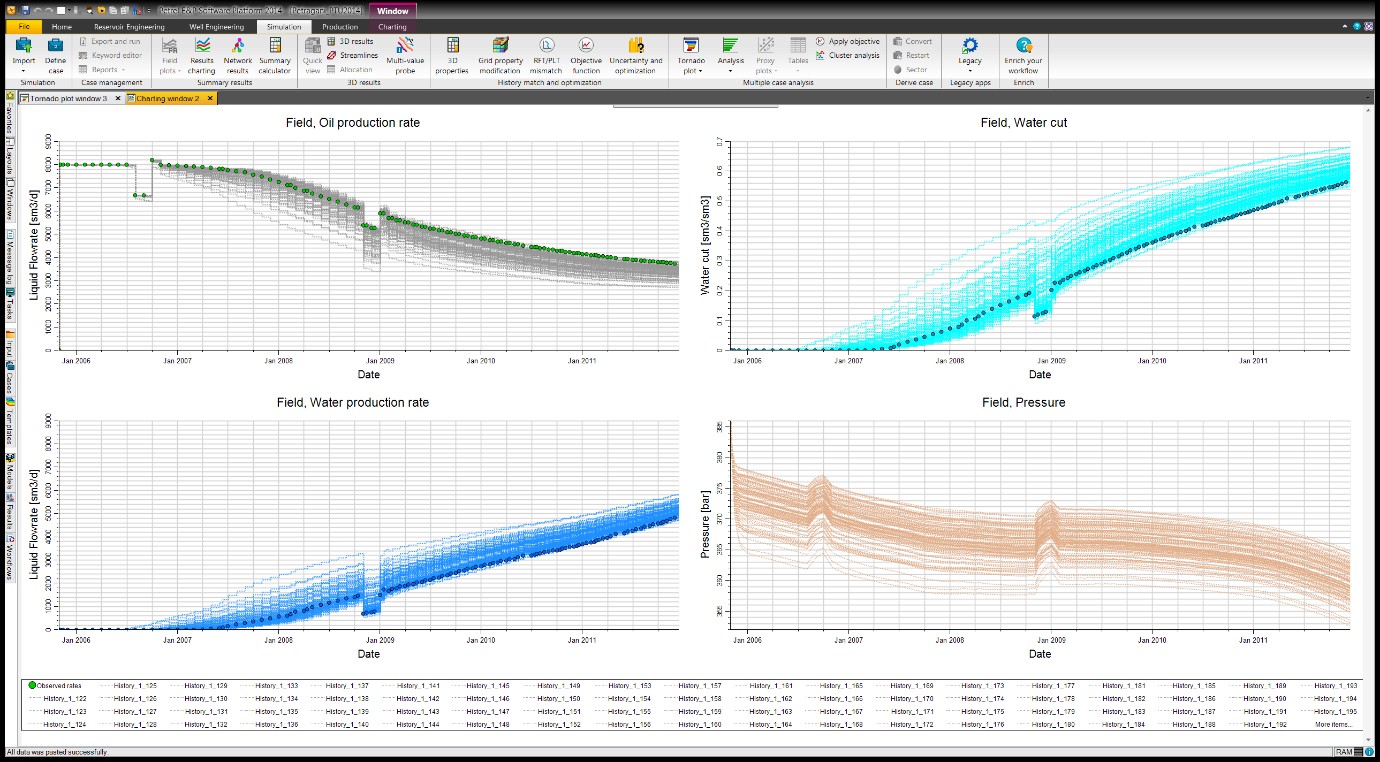

Petrel History Matching Production Forecasting Optimization

Form I 9 Acceptable Documents Uscis

Snakegrid Pointwise Xip

Http Www Americanantiquarian Org Proceedings Pdf

Japanese Submarine I 158 Wikipedia

322 Appendix B

Clinical And Histologic Evaluation Of Myelodysplastic Syndromes Ppt Download

Form I 9 Acceptable Documents Uscis

Www Researchgate Net Profile Sherif Ramadan Publication Genetic And Productive Studies On Egyptian Local And Exotic Laying Hen Breeds Links 5bcf Genetic And Productive Studies On Egyptian Local And Exotic Laying Hen Breeds Pdf

Form Fs 545 Drone Fest

Vector Selection And Ligation Thrombinase

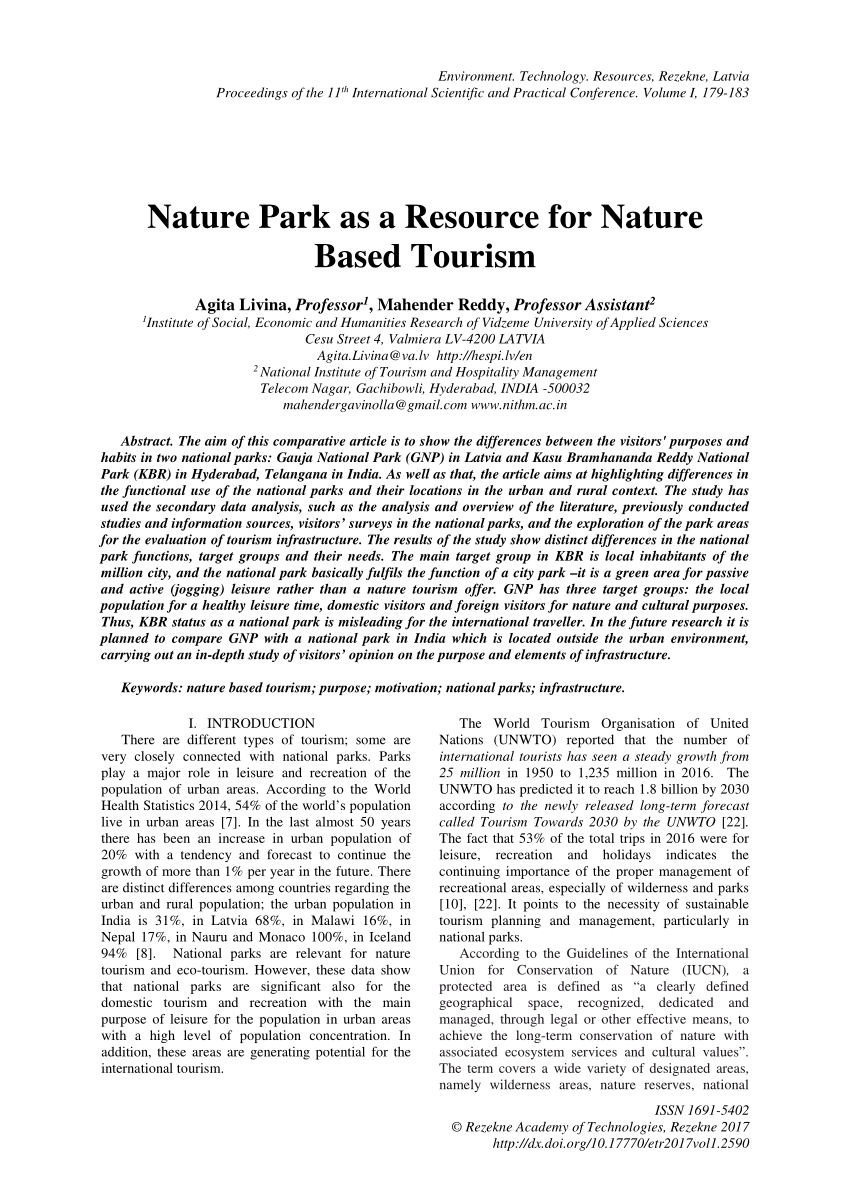

Pdf Nature Park As A Resource For Nature Based Tourism

Form I 9 Acceptable Documents Uscis

Office Du Tourisme Et Des Congres De Paris Site Officiel

Vintage Dodge Power Wagon And Plymouth Truck Parts 19s To The 1980s Dcm Classics Dcm Classics Llc

12 3 List C Documents That Establish Employment Authorization Uscis

Jg Gqetitzu0m

Www Gsa Gov Cdnstatic Doc Acceptableidformsmay514 Pdf

Firewall Control Feature Spotlight Sentinelone

Index Of Cmlhz12 Sun So1000 New Drugs And Cure Hochhaus Content

522 Appendix B

:max_bytes(150000):strip_icc()/GettyImages-953844116-dfba5a0cc61043f49cd25960e371bae9.jpg)

Section 179 Definition

Form I 9 Acceptable Documents Uscis

Management Of Myelodysplastic Syndromes Expert Consensus Opinion From The Saudi Mds Working Group Alaskar A Al Momen Ak Al Saeed A Al Sagheir A Hanbali A Al Hejazi A Al Hashmi H Al Anazi K Al

New I 9 Form Employment Eligibility Verification Blog News Legal Articles From Our Team

Computing Online Safety Cyber Snakes And Ladders Year 2 Lesson Pack 6

:max_bytes(150000):strip_icc()/550437717-56a9392b5f9b58b7d0f961d7.jpg)

How To Fill Out An I 9 Form Step By Step

1

Form I 9 Acceptable Documents Uscis

Www Gsa Gov Cdnstatic Doc Acceptableidformsmay514 Pdf

How To Buy Your First Home In Canada Moving2canada

Ipss And Ipss R Prognostic Scoring Systems For Mds Classification Download Table

Section 179 Deduction A Simple Guide Bench Accounting

Targeting Either Gh Or Igf I During Somatostatin Analogue Treatment In Patients With Acromegaly A Randomized Multicentre Study In European Journal Of Endocrinology Volume 178 Issue 1 18

Solved Fundememtals To Info Security Decimal To Hex Ciphe Chegg Com

Computing Powerpoint Presentation Skills Year 3 Unit Pack

12 3 List C Documents That Establish Employment Authorization Uscis

A Morphological Study Of Acute Myeloid Leukemia And Correlation With Clinical And Laboratory Findings Including Results Of Cytogenetic Analysis And Mutation Screening Semantic Scholar

Form I 9 Acceptable Documents Uscis

Clarion Club Houses Web Site Clarion Clubhouses

Models Form Ideas Free Form Models For Inspiration

United Arab Emirates Wikipedia

/businessman-show-analyzing-report--business-performance-concept-1034886308-650119e2f4d745f9a772c980b25a3345.jpg)

Section 179 Definition

Building Blocks Of Hope A Patient And Caregiver Guide For Living With Mds International Nursing Leadership Board The Mds Foundation Ppt Download

How A One Stop Center Processes An I 9 Ppt Video Online Download

:max_bytes(150000):strip_icc()/HeroImagesGettyImages-65a9475bbae746848eee99e8fff09f2d.jpg)

Section 179 Definition

Form I 9 Acceptable Documents Uscis

Shijim Kitchen Bar Menu Menu For Shijim Kitchen Bar Civil Lines Nagpur

Luxury Retirement Communities For Active Adults And 55 Seniors Apply Online

I 17q Solely In Myeloid Malignancies

I 9 Training Program Utah State University Human Resources Ppt Video Online Download

Q Tbn And9gctmzv66q Extt8go0lvud1rtryrwuzqanfaqfrx90yfcvjoqvg6 Usqp Cau

Martha Stewart Collection Essentials Quilted Waterproof Full Mattress Pad I179 Mattress Pads Feather Beds Home Garden Worldenergy Ae

Transport And Disability Getting Around Paris Paris Tourist Office

00833-4/attachment/804bc3e6-0e4d-4be8-9e8f-f783883cdd90/mmc1.jpg)

Raptor A Binding Partner Of Target Of Rapamycin Tor Mediates Tor Action Cell

Hybrydka Semilac 0 I 179 Na Pazurki Zszywka Pl

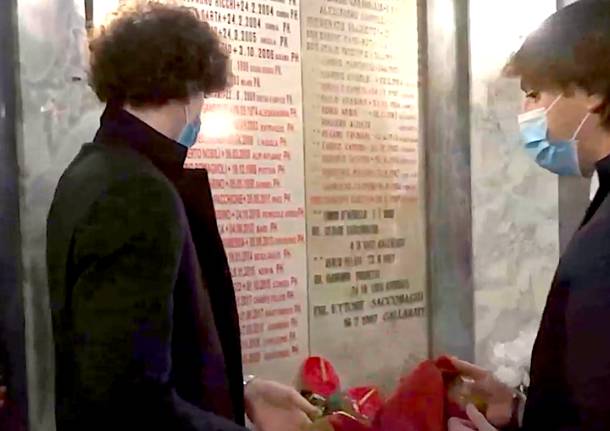

Nel Tempio Di Duno Il Ricordo Commosso Per I 179 Medici D Italia Morti Per Covid

Form I 9 Acceptable Documents Uscis

Martha Stewart Collection Essentials Quilted Waterproof Full Mattress Pad I179 Mattress Pads Feather Beds Home Garden Worldenergy Ae

Form I 9 Refresher Training Cwd March Pdf Free Download

Http Www Dps Texas Gov Internetforms Forms Dl 17 Pdf Tb Iframe True Tb Iframe True

Pogchamp Transparent Background Png Cliparts Free Download Hiclipart

On Call Notary Llc

How Micro Is Payara Micro Dzone Java

Afid

Ppt I 9 Powerpoint Presentation Free Download Id

Form I 9 Acceptable Documents Uscis

Skal Ha Kjort I 179 Kilometer I Timen Med Politiet Bak Seg

Index Of Files H Images