Apr 1399

Best Balance Transfer Cards Of 21 Nextadvisor With Time

What Is Apr The Simple Dollar

Best Balance Transfer Cards Of March 21 Reviews Top Bonuses Offers

7 Best 0 Apr Credit Cards No Interest For Months

Hsbc Gold Credit Card

How To Compare Credit Card Interest Rates Experian

From here you would need to solve the equation for i and calculate i Multiplying i x 12 gives you the APR = 5547% You can use the Loan Calculator to calculate the APR = 5547% This is this example using this APR Calculator The calculation for i is not shown here because finding the interest rate is a complex calculation involving the NewtonRaphson Method which you can read about at MathWorld.

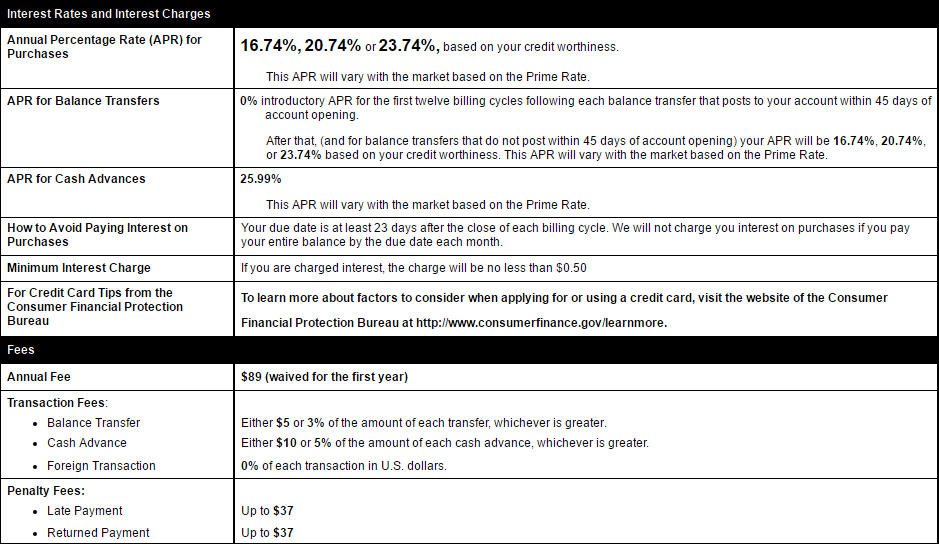

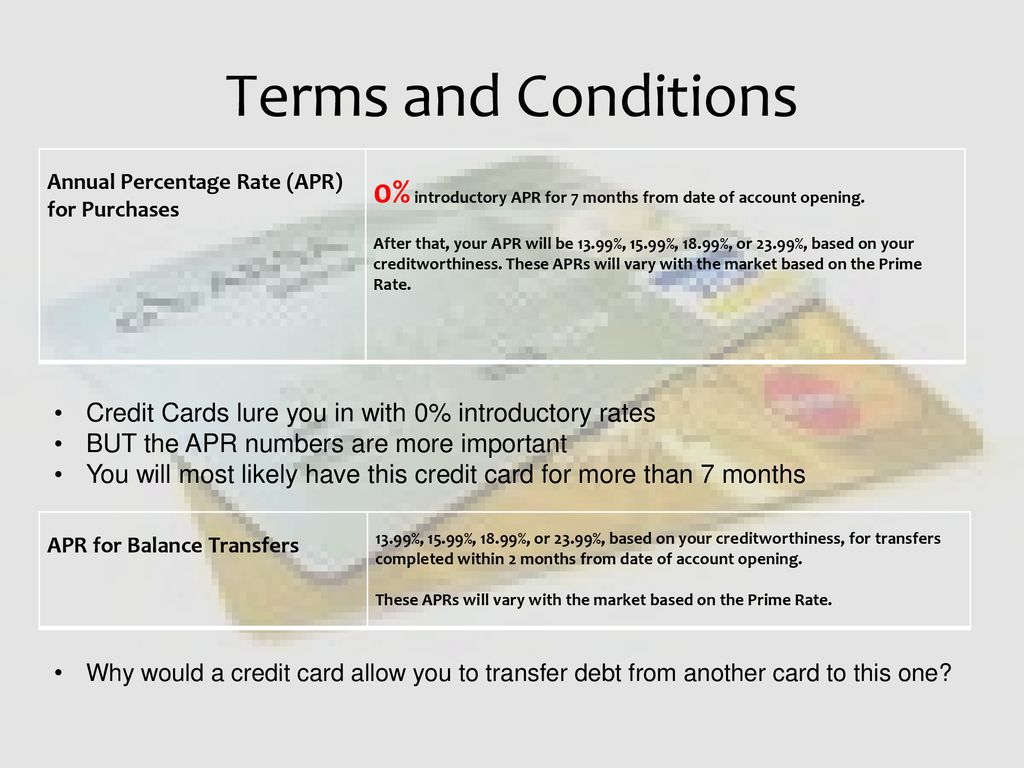

Apr 1399. After that, APR varies between 1399% to 2399%, depending on your credit score If you have another credit card, such as one that earns cash back or travel rewards, we’d recommend using that one. 15 months of 0% intro APR 1299% to 2299% variable Bank of America® Cash Rewards Credit Card 15 statement closing dates of 0% intro APR 1399% to 2399% variable Citi® Double Cash Card 18 months of 0% intro APR 1399% to 2399% variable Wells Fargo Platinum Card 18 months of 0% intro APR 1549% to 2499% variable HSBC Gold. APR 1399% 2399%* (Variable) Balance Transfer Intro APR 0% introductory APR for the first 12 billing cycles for balances transferred within 60 days from account opening Balance Transfer Fee Either 3% of the amount of each transfer or $5 minimum, whichever is greater.

15 months of 0% intro APR 1299% to 2299% variable Bank of America® Cash Rewards Credit Card 15 statement closing dates of 0% intro APR 1399% to 2399% variable Citi® Double Cash Card 18 months of 0% intro APR 1399% to 2399% variable Wells Fargo Platinum Card 18 months of 0% intro APR 1549% to 2499% variable HSBC Gold. 2399%, based on your creditworthiness This APR will vary with the market based on the Prime Rate No grace period will apply when calculating finance charges for Overdraft Advances If your linked credit card account is changed to a closed status for any reas on, Union Bank may terminate the Overdraft Protection Linked to a. Enjoy 0% Intro APR for 6 months from account opening on all purchases made with your PlayStation Card After that, a purchase APR of 1399%–2274% applies § Also, get started with 1,000 bonus points when you make a PlayStation TM Store purchase within 60 days of account opening §§.

Balance $ APR (%) Days in Month Days in Year Interest Per. If the APR is 1399%, then the monthly rate is % ( 1399/12 ) A balance of $ would then costs 2500 * (/100 ) = $ or $2915. Just be aware though that once the intro period expires, standard 1399% – 2399% (Variable) APR applies, so it's important to pay off your balance in full within the intro time frame to avoid paying any interest once it expires Citi is a CardRatings advertiser.

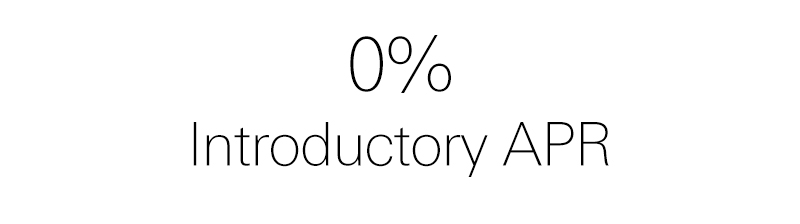

Annual Percentage Rate (APR) for Purchases 000%;. 2399%, based on your creditworthiness This APR will vary with the market based on the Prime Rate APR for Balance Transfers. The best balance transfer credit cards have a low balance transfer fee (sometimes $0), a 0% intro APR on balance transfers for longer than a year, and a regular APR below % Even the best balance transfer cards are known for having pretty high regular rates, which is why it's best to pay off your transferred balance before they take effect.

Balance $ APR (%) Days in Month Days in Year Interest Per. APR for Balance Transfers 0% Introductory APR for the first 12 Statement Closing Dates following the opening of your account for transactions made within 60 days of opening your account After that, your APR will be 1399% to 2399%, based on your creditworthiness when you open your account This APR will vary with the market based on the Prime Rate. The card also provides a helpful intro 0% APR for the first 12 months on purchases, which can help you finance large purchases (after, 1399% to 2399% variable APR) Blue Cash Preferred® Card.

Regular APR (%) 1399% 2399% variable Annual Fee $0 Rewards Earning Rate 3x points per dollar on eligible travel purchases 2x points on purchases made at grocery stores, gas stations, wholesale clubs and drugstores 1x point for every dollar you spend on purchases anywhere else Foreign transaction fee (%) 0%. If the APR is 1399%, then the monthly rate is % ( 1399/12 ) A balance of $ would then costs 2500 * (/100 ) = $ or $2915. Regular APR (%) 1399% 2399% variable Annual Fee $0 Rewards Earning Rate 3x points per dollar on eligible travel purchases 2x points on purchases made at grocery stores, gas stations, wholesale clubs and drugstores 1x point for every dollar you spend on purchases anywhere else Foreign transaction fee (%) 0%.

Overdraft Advance APR 1399%to 2524% APRs may be nonvariable, or may vary with the market based on the Prime Ratec Your due date will be a minimum of 21 days after the close of each billing cycle We will not charge you interest on purchases if you pay your entire balance by the due date each month. Unlimited 15% Cash Back on your purchases Low intro APR 0% for 15 months on purchases from the date of account opening, then a variable rate, currently 1399% to 2399% Plan It® gives the. The APR can help you evaluate all offers and promotions Generally, lenders cannot change the APR for the first 12 months However, an APR can change in that period if it’s a promotional or variable rate or if the terms and conditions are violated Consumers should review terms and conditions, including the APR, before using their cards.

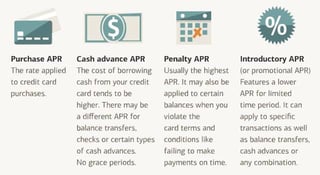

APR is annual percentage rate The way it usually works on a credit card is for each month they figure your average daily balance Then they take the APR and divide it by 365 (days in a year) to get the daily rate The daily rate is then multiplied by the average daily balance This gives you the interest amount for one day. The standard variable APR for Citi Flex Plan is 1399% – 2399% based on your creditworthiness Citi Flex Plan offers are made available at Citi’s discretion * See the online provider's credit card application for details about terms and conditions Reasonable efforts are made to maintain accurate information. Im 18 so i dont expect it to be really low, but this was the offer my banks site gave me i need a credit card to by gas and i want to build my credit for the future, please help so i dont do anything stupid.

Low intro APR 0% for 15 months on purchases from the date of account opening, then a variable rate, 1399% to 2399% Plan It® gives the option to select purchases of $100 or more to split up into monthly payments with a fixed fee Cash back is received in the form of Reward Dollars that can be easily redeemed for statement credits. Balance Transfer Offer 0% intro APR on Balance Transfers for 18 months After that, the variable APR will be 1399% 2399%, based on your creditworthiness Balance Transfers do not earn cash back and will have a fee of either $5 or 3% of the amount of each transfer, whichever is greater. APR 0% intro APR on purchases for 12 months from the date of account opening, then a variable APR, 1399% to 2399% ¤.

Made more than 60 days from account opening, 1399% to 1799% (based on your credit worthiness) if your Balance Transfer is treated as a Purchase, or 2499% if your Balance Transfer is treated as a Cash Advance These APRs will vary with the. I dont know much about credit cards but im going to apply for my 1st one it said o% apr for the first year, then 1399% to 1999% APR after that, is this a good deal?. Low intro APR 0% for 15 months on purchases from the date of account opening, then a variable rate, 1399% to 2399% Plan It® gives the option to select purchases of $100 or more to split up.

Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases To earn cash back, pay at least the minimum due on time Balance Transfer Offer 0% intro APR on Balance Transfers for 18 months After that, the variable APR will be 1399% 2399%, based on your creditworthiness. Wilson NCAA Copia Soccer Ball (Sz5) Amazon $1399 Walmart $1399 Not sure how much slickdeals snoops around on peoples phones I was just searching for a soccer ball on the target app earlier today. It offers an intro 0% intro APR on Balance Transfers for 18 months, and then the ongoing APR of 1399% 2399% Variable APR Store credit cards can have even higher APRs than general rewards.

After that, the variable APR will be 1399% 2399%, based on your creditworthiness Balance Transfers do not earn cash back If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month. 0% Introductory APR for 12 billing cycles for purchases, and for any balance transfers made in the first 60 days After the intro APR offer ends, 1399% 2399% Variable APR will apply A 3% fee (min $10) applies to all balance transfers No expiration on rewards. 0% intro APR on purchases for 12 months from the date of account opening, then a variable APR, 1399% to 2399%.

Use this APR calculator to compare different APR options The low, promotional interest rates offered by many auto finance companies and other lenders can result in significant savings on your next auto purchase Lower interest rates mean lower total interest costs and lower monthly payments Javascript is required for this calculator If you are using. If you have a 1399% APR (Annual Percentage Rate) on a balance of $ then you will be spending $040 per day, $1199 per month, and $145 per year on interest Want to calculate more credit card interest?. A good APR for a first credit card is anything below % The best low interest first time credit card is the Bank of America® Cash Rewards Credit Card for Students because it offers introductory APRs of 0% for 12 months on purchases and 0% for 12 months on balance transfers, with a regular APR of 1399% 2399% (V).

1399% 2399% Variable APR Rec Credit Score 7850 Excellent Product Details Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those. The Citi® Double Cash Card – 18 month BT offer offers a regular purchase APR of 1399% – 2399% (Variable) Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases The Discover it® Cash Back comes with a regular purchase APR of 1199% 2299% Variable APR. Intro APR Offer 000% Intro APR for 18 months from account opening on purchases and balance transfers (followed by the standard variable APR of 1399% – 2399%) Annual Fee $0 Welcome Offer None.

Purchase intro 0%12 months after that the variable APR will be 1290% 2290% , based on your creditworthiness Regular APR 1290% 2290% (Variable) Balance Transfer Intro APR N/A Balance Transfer Intro Period N/A Annual fee $0 Navy Federal Visa cashRewards Card. After that, the variable APR will be 1399% 2399%, based on your creditworthiness Balance Transfers do not earn cash back and will have a fee of either $5 or 3% of the amount of each transfer, whichever is greater. A credit card issuer charges an APR of 1399%, and its billing cycle is 30 days long its periodic interest rate would be 115% The correct answer between all the choices given is the second choice or letter B.

As an example, one of my credit cards has a variable APR that is calculated as the US prime rate plus 1399% In other words, if the prime rate was 4%, this means that my APR would be 1799%. Intro APR Offer 000% Intro APR for 18 months from account opening on purchases and balance transfers (followed by the standard variable APR of 1399% – 2399%) Annual Fee $0 Welcome Offer None. The standard variable APR for Citi Flex Plan is 1399% 2399%, based on your creditworthiness Citi Flex Plan offers are made available at Citi's discretion.

APR 0% intro APR on purchases for 12 months from the date of account opening, then a variable APR, 1399% to 2399% ¤. If you have a 1399% APR (Annual Percentage Rate) on a balance of $ then you will be spending $040 per day, $1199 per month, and $145 per year on interest Want to calculate more credit card interest?. Use this APR calculator to compare different APR options The low, promotional interest rates offered by many auto finance companies and other lenders can result in significant savings on your next auto purchase Lower interest rates mean lower total interest costs and lower monthly payments Javascript is required for this calculator If you are using.

Low Interest Credit Cards Lowest Rates March 21 Bankrate

Best Bank Of America Credit Cards Nextadvisor With Time

What Is A Good Credit Card Apr 15 Best Low Interest Rate Cards

Why Your Credit Card Apr Is Going Up And What To Do About It

What Is The Average Credit Card Interest Rate

Best Low Interest Credit Cards Of February 21 Us News

Best 0 Apr Balance Transfer Offers In 21 Awardwallet Blog

Key Cashback Credit Card Review Bestcards Com

Best Low Interest Credit Cards 21 Low Apr Offers Creditcards Com

Best Low Interest Credit Cards 21 Low Apr Offers Creditcards Com

Best 0 Apr Credit Cards Of March 21 0 Aprs Until 22

American Express Blue Cash Everyday Review Nextadvisor With Time

Hsbc Gold Credit Card

Best 0 Apr Credit Cards Of February 21 Nextadvisor With Time

Best Low Interest Credit Cards Of March 21 Us News

3 Ways How To Get A Lower Interest Rate On Credit Cards Cardrates Com

Harley Davidson Visa Credit Card From U S Bank Refer A Friend

The Best 0 Apr And Low Interest Credit Cards January 21

Credit Protection Insurance Sweethome4u

Playstation Visa Credit Card

Best Low Interest Credit Cards Of March 21 0 Aprs Until 22 The Ascent

Bvo4g0aiwzq Wm

Best 0 Apr Credit Cards Of February 21 Nextadvisor With Time

Best 0 Intro Apr Credit Cards Of February 21 Reviews Top Offers

Best Balance Transfer Credit Cards Cnet

Credit Card Interest Calculator How Much Interest I Will Pay

Approved Avianca Vida Visa Card 50 000 13 99 Myfico Forums

Harley Davidson Visa Credit Card From U S Bank

/what-does-apr-mean-315004-v3-jl-442b370734d44759ac43d09edcc3fb26.png)

What Apr Tells You About A Loan

Best Balance Transfer Credit Cards Cnet

Citi Double Cash Card Credit Karma

Credit And Its Importance Ppt Download

How To Calculate Credit Card Interest To Figure Out How Much You Owe

Best 0 Apr Balance Transfer Offers In 21 Awardwallet Blog

21 S Best Credit Card Rates Months With 0 Rates

What Is An Intro Apr And How Does It Work Creditcards Com

A Credit Card Issuer Charges An Apr Of 13 99 And Its Billing C

Amazon Com Chase Freedom Credit Card Credit Card Offers

Best Rewards Credit Cards Featuring 0 Apr On Purchases Awardwallet Blog

What Is A Good Apr For A Credit Card Rates By Score

What Is Apr Annual Percentage Rate Guide For 21

How To Calculate Apr On A Credit Card 3 Easy Steps Cardrates Com

Best Balance Transfer Credit Cards Cnet

What Is Apr On A Credit Card 9 Best Low Interest 0 Apr Cards

How Credit Card Balance Transfers Work Credit Card Insider

Blue Cash Everyday Credit Card American Express

What Factors Do Lenders Consider When Determining My Apr

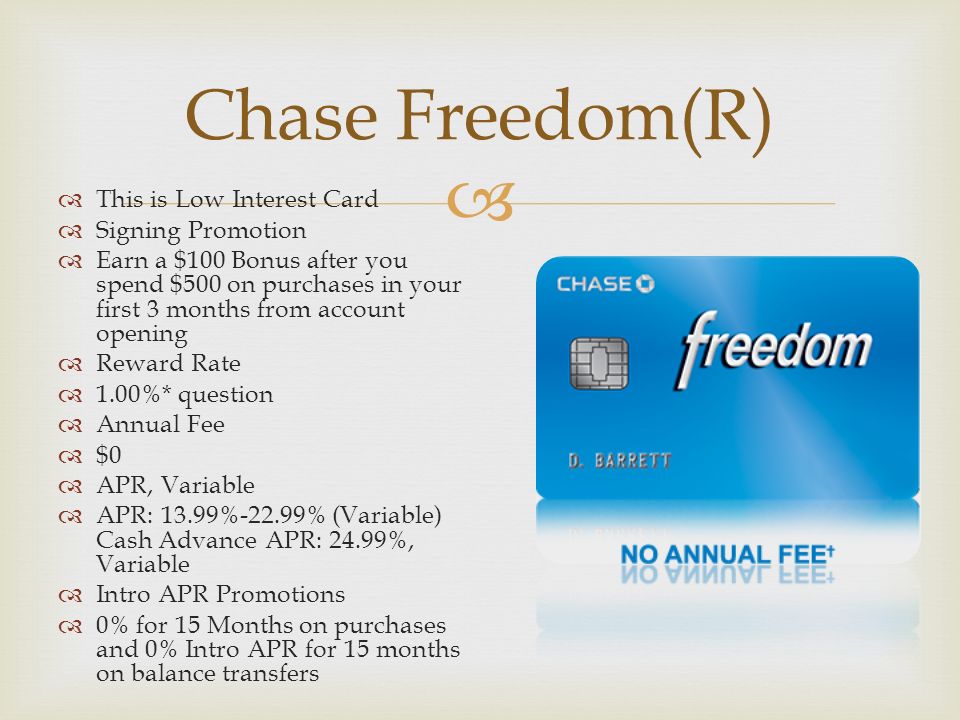

By Aria Liu Annual Fee No Annual Fee Apr 0 Intro 13 99 24 99 Rebates Rewards 1 Point Per On Gas Groceries Or Other 25 Points For 1 St Ppt Download

Approved Avianca Vida Visa Card 50 000 13 99 Myfico Forums

Best 0 Apr Credit Cards Of January 21 Zero Interest Financing

/Apples-keynote-event_Jennifer_Bailey_introduces_apple_card-03252019-081e8c60bbf546e8a025b57cd457040c.jpg)

Apple Credit Card Interest Rate How Does It Compare

Pin On Abbeville First Bank Online Banking

By Aria Liu Annual Fee No Annual Fee Apr 0 Intro 13 99 24 99 Rebates Rewards 1 Point Per On Gas Groceries Or Other 25 Points For 1 St Ppt Download

U S Bank Visa Platinum Card Review Nextadvisor With Time

Citi Diamond Preferred Credit Card Review 0 Intro Apr For 18 Months Business Insider

Bankamericard 21 Review Pros Cons And More The Ascent By Motley Fool

The Citi Double Banknote Agenda Offers A 0 Addition Apr On Antithesis Transfers For 18 Months 13 99 Wells Fargo Checking Money Market Account Wells Fargo

American Express 0 Apr Credit Cards

What S A Good Apr For A Credit Card Bankrate

21 S Best Credit Card Rates Months With 0 Rates

Best Balance Transfer Credit Cards Of March 21 Bankrate

Best 0 Apr Credit Cards With No Annual Fee The Points Guy

How To Use A 0 Apr Credit Card As An Interest Free Loan Forbes Advisor

What Is A Good Apr For A Credit Card Nerdwallet

How To Get A 0 Intro Apr Without Paying A Balance Transfer Fee Awardwallet Blog

Best Low Interest Credit Cards Of March 21 0 Aprs Until 22 The Ascent

Credit Cards With Long 0 Apr Periods Nerdwallet

Best Balance Transfer Credit Cards Cnet

What Is Apr Annual Percentage Rate Guide For 21

Blue Cash Preferred Card American Express

Apr Vs Interest Rate Is There A Difference 21

How Do 0 Apr Credit Cards Work

Hsbc Credit Cards Hsbc Bank Usa

U S Bank Visa Platinum 21 Review The Ascent

Locke Bandi Mm255 Unit5 Assignment Unit 5 Assignment Brandi Locke Mm 255 Business Math Unit 5 Assignment 1 Unit 5 Assignment Project Get Started On Course Hero

Best 0 Apr Credit Cards 0 Interest Until 22 Bankrate

Best Balance Transfer Credit Cards Cnet

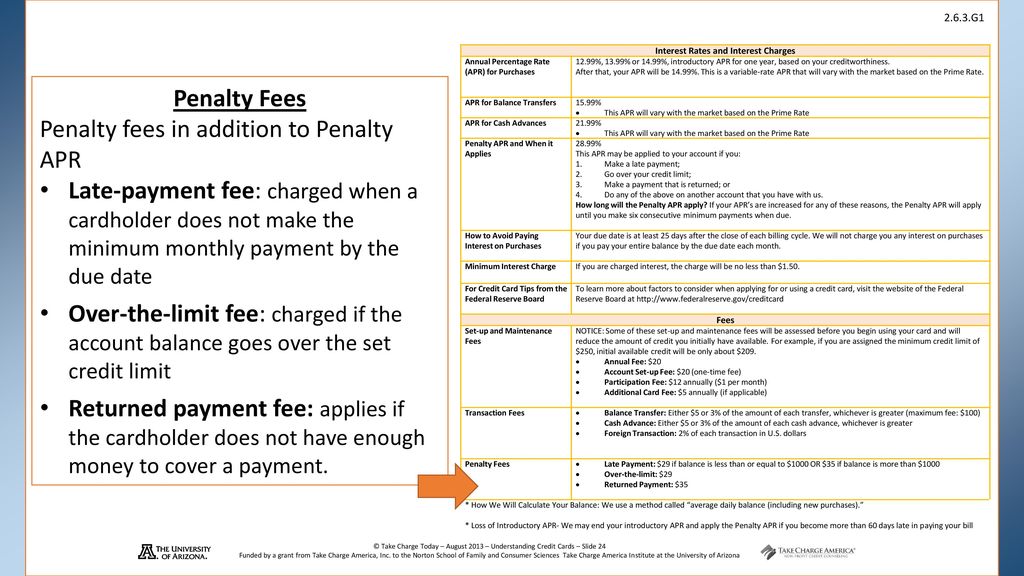

Understanding Credit Cards Ppt Download

What Is Apr On A Credit Card 9 Best Low Interest 0 Apr Cards

Best 0 Intro Apr Credit Cards Of February 21 Credit Karma

Credit Card Comparison Ppt Video Online Download

Hsbc Credit Cards Hsbc Bank Usa

13 Longest 0 Apr Credit Card Offers 21

Best 0 Introductory Apr Credit Cards Of February 21 Us News

Green Dot Primor Mastercard Gold Secured Credit Card And Gold Cards Review Read Before You Apply

By Aria Liu Annual Fee No Annual Fee Apr 0 Intro 13 99 24 99 Rebates Rewards 1 Point Per On Gas Groceries Or Other 25 Points For 1 St Ppt Download

Hsbc Gold Mastercard 21 Review Forbes Advisor

Best 0 Apr Credit Cards Of 21 No Interest For Up To Months

What Is An Ongoing Apr Creditcards Com

What Is A Good Apr For A Credit Card Rates By Score

Best Zero Interest Credit Cards December Cnn Underscored

Best No Annual Fee Credit Cards Nextadvisor With Time

Longest 0 Intro Apr Credit Cards Comparecards

Do I Qualify For New 0 Apr Offers