499r 2w 2pr Form

Comprobantes De Retencion W2 499 R 2 W 2pr La Isla Oeste

19 Electronic Filing Requirements For Form 499r 2 W 2pr Grant Thornton

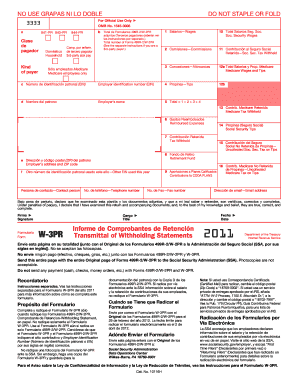

Fillable Online W 3pr 12 Form Fax Email Print Pdffiller

Irs Instruction W 3pr 19 Fill And Sign Printable Template Online Us Legal Forms

Tax Planning Checklist Rsm Puerto Rico

Ye10us9e

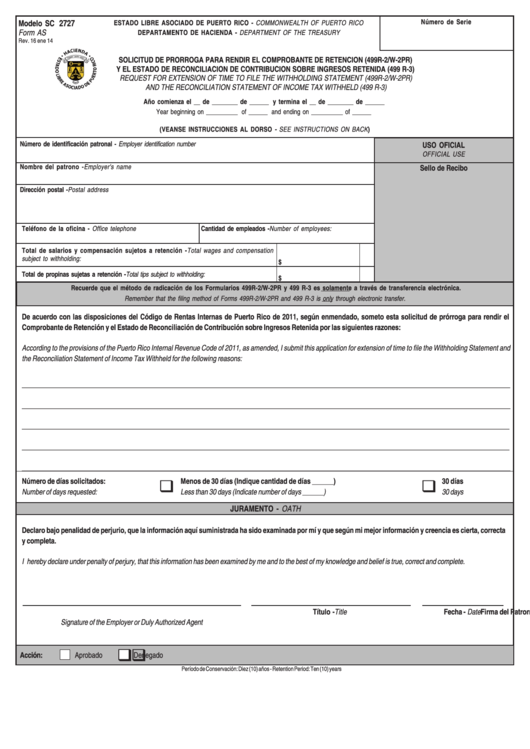

The Department of the Treasury has required the electronic filing of Form AS 2727 “Request of Extension of Time to File the Withholding Statement (W2PR) and Reconciliation Statement of Income Tax Withheld (499R3) The electronic application is available through the PRTD’s website.

499r 2w 2pr form. Form 499R2/W2PR, including all information reported Complete the electronic transfer before the due date in order to avoid late filing penalties Email address is required at RA record, location Reimbursed Expenses includes Fringe Benefits (RS State Record, location ) and (RV State Total Record, location 3347). Instructions for filing Form 499R2/W2PR Copy A (W2) information to the Department of the Treasury through electronic transfer using the MMW2PR1 format Who must use these instructions?. You will be penalized by the Department of the Treasury.

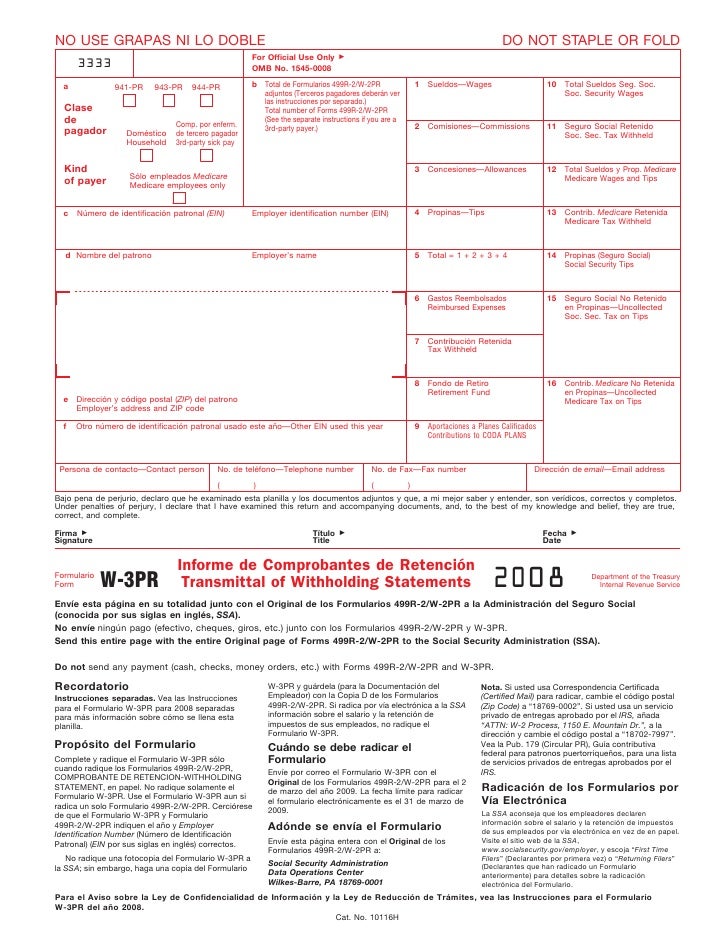

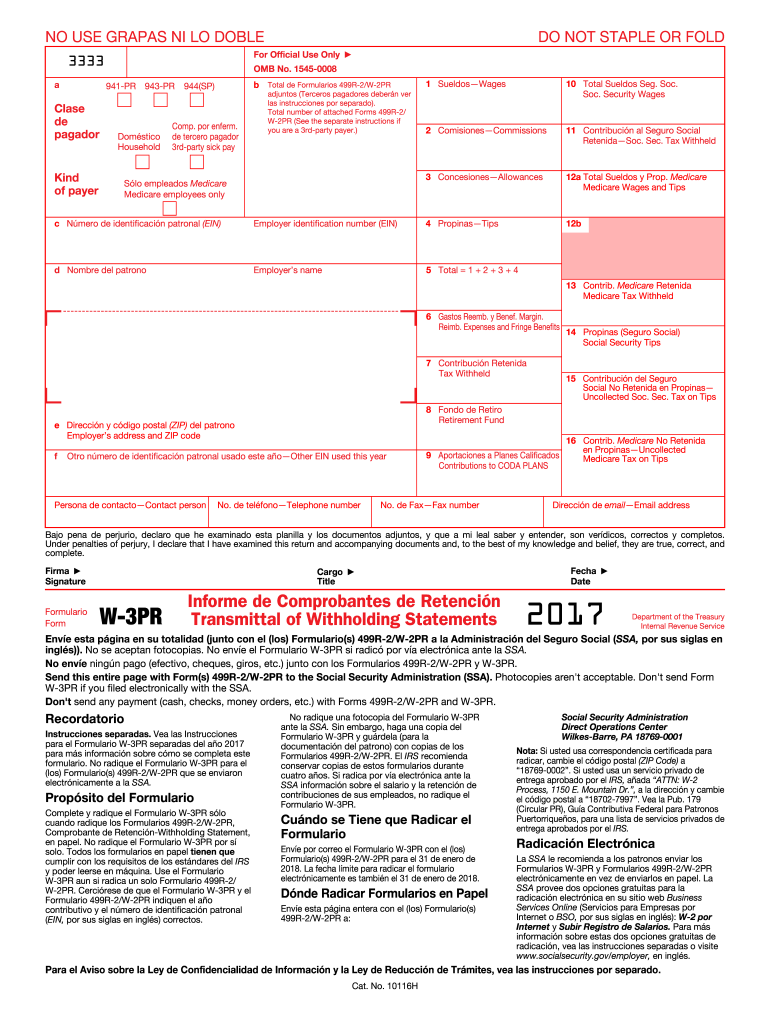

Form 499r2/w2pr Fill Online, Printable, Fillable Blank formw3prcom form 499r2/w2pr Online solutions help you to manage your record administration along with raise the efficiency of the workflows Stick to the fast guide to do Form W3PR, steer clear of blunders along with furnish it in a timely manner. Regarless of whether you file on paper or electronically, you must file Form 499R2/W2PR along with Form W3PR with the SSA by February 1, 21 You may owe a penalty for each Form 499R2/W2PR you file late. You may file Form W3PR along with Forms 499R2/W2PR electronically on the SSA’s website at Employer W2 Filing Instructions and Information You can create fillin versions of Forms 499R2/W2PR and W3PR for filing with SSA.

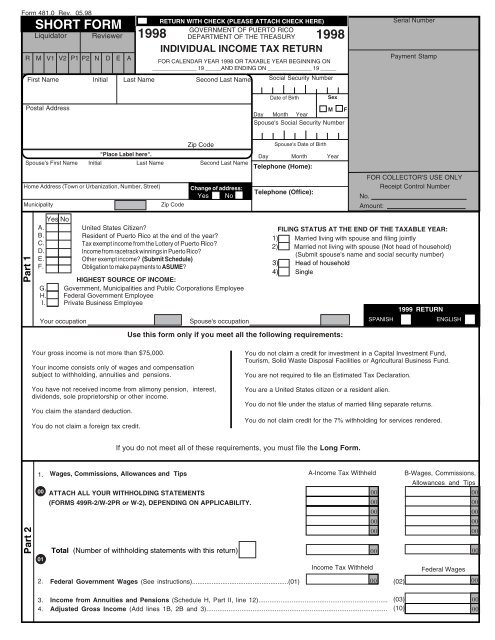

GU�A PATRONAL COMO PROCESAR CORRECTAMENTE EL FORMULARIO 499R2/W2PR SOBRE SALARIOS DE EMPLEADOS EN PUERTO RICO ESTA GU�A ES PREPARADA EN ESPA�OL E INGL�S PARA EL TEXTO EN INGLES VAYA A LA PAG 24 THIS GUIDE IS PUBLISHED IN SPANISH AND ENGLISH. A US tax return (Form 1040) reporting all worldwide income If you are double taxed by both the US and Puerto Rico, you can claim a foreign tax credit on Form 1116 for the income taxes paid to Puerto Rico Since these rules can easily become complicated very quickly, you may want to speak to a tax prep professional at H&R Block. To print a 499R2/W2PR form From the Reports menu, choose Payroll, then choose Print 499R2/W2PR Forms You cannot display 499R2/W2PR information However, you can display the same information in the yeartodate Employee Summary report.

On the dotted line next to Form 1040, line 38, enter the amount excluded and identify it as “EPRI” Also attach a copy of any Form (s) 499R2/W2PR to your return Any amount on Line 45 or Line 50 of Form 2555, Foreign Earned Income Any amount on Line 18 of Form 2555EZ, Foreign Earned Income Exclusion. You can submit corrections to W2s processed information using magnetic media (MMW2PR1) or using paper Form 499R2c/W2cPR The resubindicator in the RA records must be "1" If you correct an employee record, put "1" in the amendmentindicator in the RS record Send the MMW2PR1 file with the corrections or amendments. COMPROBANTE DE RETENCION 499R2/W2PR MANUAL DE USUARIO Página 13 Colecturía Virtual IV Presentación del Comprobante de Retención 499R2/W2PR Para imprimir su Comprobante de Retención 499R2/W2PR oprima el botón de que se encuentra en la esquina superior izquierda.

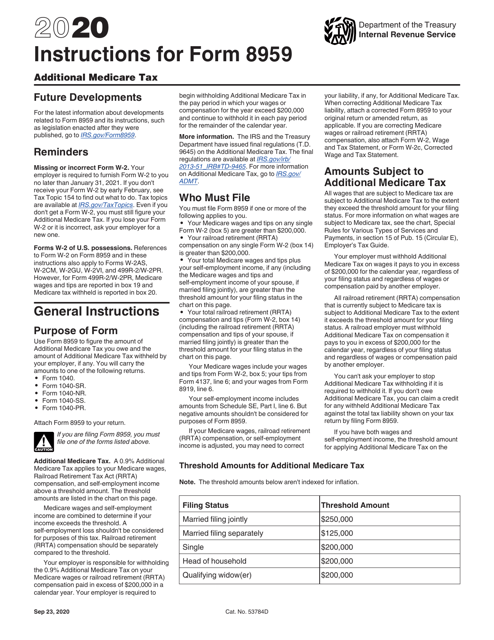

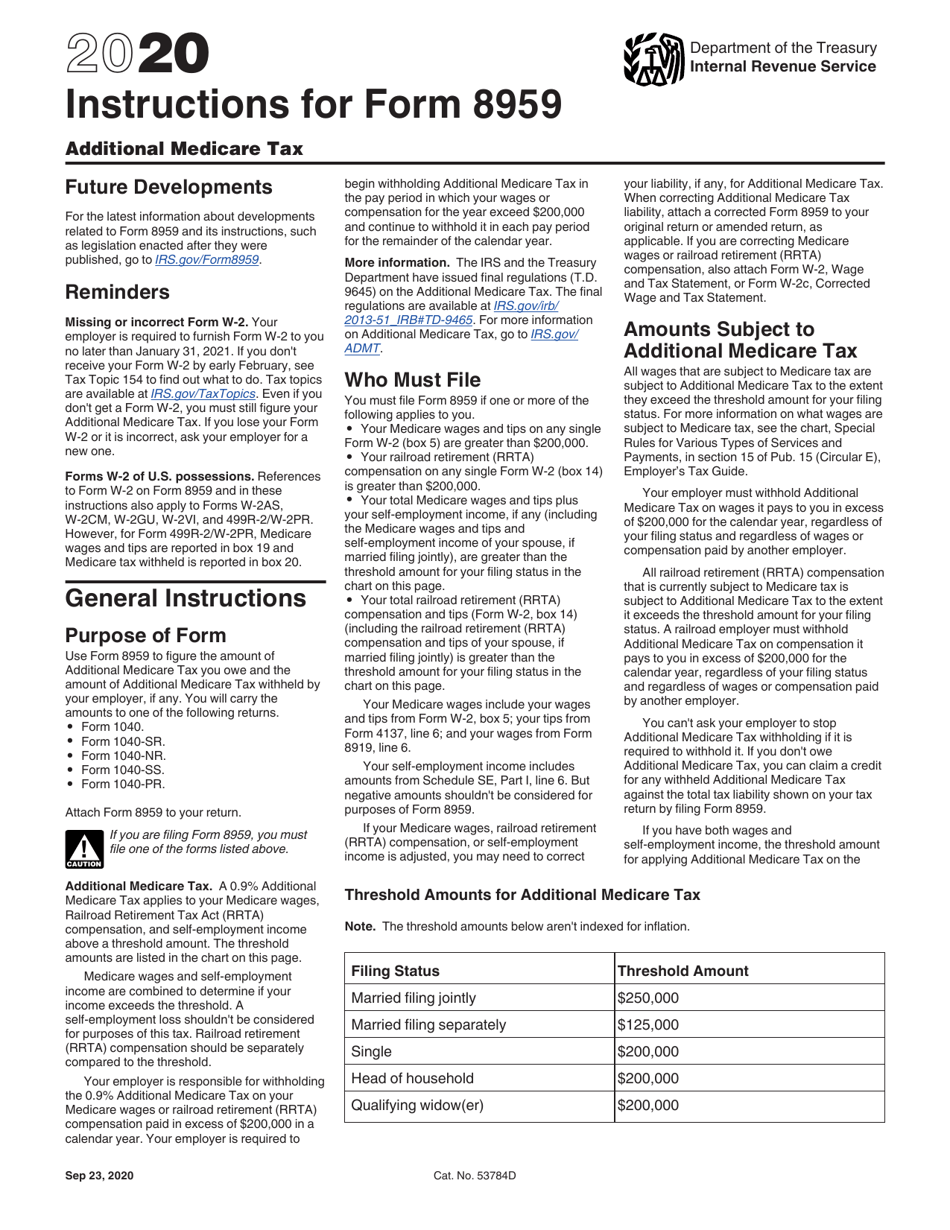

Forms W2 of US possessions References to Form W2 on Form 59 and in these instructions also apply to Forms W2AS, W2CM, W2GU, W2VI, and 499R2/W2PR However, for Form 499R2/W2PR, Medicare wages and tips are reported in box 19 and Medicare tax withheld is reported in box. Therefore, the signNow web application is a musthave for completing and signing form 499r 2 w 2pr on the go In a matter of seconds, receive an electronic document with a legallybinding esignature Get form 499r 2 w 2pr signed right from your smartphone using these six tips Type signnowcom in your phone’s browser and log in to your account. Notwithstanding the foregoing, if an employer is required to make a final return on Form 941, or a variation thereof, and expedited filing of Forms W2, Forms 499R2/W2PR, Forms W2VI, Forms W2GU, or Form W2AS is required, the unavailability of the specifications for magnetic media filing will be treated as creating a hardship (see § (a)1 (a) (3) (ii) of this chapter).

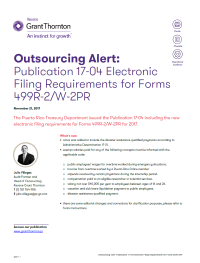

Employers with 3 or more W2 Forms to submit using private programs, that is, any program other than our Hacienda’s web program However, employers submitting 2. On October 3, 19, the Puerto Rico Treasury Department (PRTD) issued Publication 1901 to provide the electronic filing instructions for Form 499R2/W2PR What’s New Two new fields have been incorporated to the Form to indicate if the remuneration includes payments to the employee for the following services. The forms (499R2/W2PR) must be file by February 1, 21 the forms (4806A, 4806B, 4806D, & 4807F) must be file by March 1, 21 the forms (4806C) must be file by April 15, 21 the forms (4807E) must be file on or before the due date of the income tax return, including extensions.

Employers with 5 or more W2 Forms to submit What if I have 5 or more W2s and I send you paper W2s?. August 14, 17 Puerto Rico has released 17 versions of Form SC 27, Form 499R2/W2PR, Form 499R2c/W2cPR While there are some slight changes in wording and updated contact information to the newly released forms, the most significant change is the addition of a new Code F to Form 499R2/W2PR. On October 3, 19, the Puerto Rico Treasury Department (PRTD) issued Publication 1901 to provide the electronic filing instructions for Form 499R2/W2PR What’s New Two new fields have been incorporated to the Form to indicate if the remuneration includes payments to the employee for the following services.

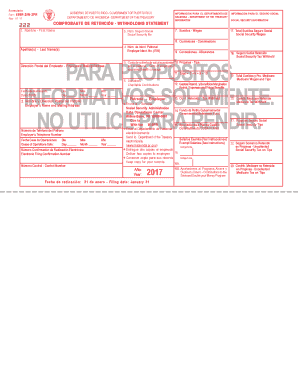

GU�A PATRONAL COMO PROCESAR CORRECTAMENTE EL FORMULARIO 499R2/W2PR SOBRE SALARIOS DE EMPLEADOS EN PUERTO RICO ESTA GU�A ES PREPARADA EN ESPA�OL E INGL�S PARA EL TEXTO EN INGLES VAYA A LA PAG 24 THIS GUIDE IS PUBLISHED IN SPANISH AND ENGLISH. Form 499R2/W2PR, including all information reported Complete the electronic transfer before the due date in order to avoid late filing penalties Email address is required at RA record, location Reimbursed Expenses includes Fringe Benefits (RS State Record, location ) and (RV State Total Record, location 3347). INFORMACIÓN PARA EL SEGURO SOCIAL SOCIAL SECURITY INFORMATION Formulario Form 499R2/W2PR Rev 07 GOBIERNO DE PUERTO RICO GOVERNMENT OF PUERTO RICO DEPARTAMENTO DE HACIENDA DEPARTMENT OF THE TREASURY Fecha de radicación 31 de enero Filing date January 31 Costo de cubierta de salud auspiciada por el patrono Cost of employer.

Form # lw2pr 1a l252 formulario formulario form form 499r2/w2pr 499r2/w2pr rev 0816 rev 0816 estado libre asociado de puerto rico commonwealth of puerto rico estado libre asociado de puerto rico commonwealth of puerto rico departamento de hacienda department of the treasury departamento de hacienda department of the. Form 499r2/w2pr Fill Online, Printable, Fillable Blank formw3prcom form 499r2/w2pr Online solutions help you to manage your record administration along with raise the efficiency of the workflows Stick to the fast guide to do Form W3PR, steer clear of blunders along with furnish it in a timely manner. However, Medicare wages and tips are reported in box 19 and Medicare tax withheld is reported in box for Form 499R2/W2PR Form 59 instructions In order to file for the IRS form 59, firstly, you will need to calculate the amount of Additional Medicare Tax withheld by your employer, if any and the amount of Additional Medicare Tax that you owe.

FORM 499R2c/W2cPR ELECTRONIC FILING REQUIREMENTS FOR TAX YEAR 16 Analysis and Programming Division January, 17 EFW2CPR i WHAT’S NEW New Field 1 Date of Birth (E0 Employee Wage Records, positions ) 2 Exempt Salaries (Box 16A), (E1 Originally Reported Records, positions 248 258), (E2 Correct Information Records, positions 248. Use this form to transmit Form(s) 499R2/W2PR to SSA Current Revision Form W3 (PR) (in Spanish) PDF About Form W3 (PR), Transmittal of Withholding Statements Internal Revenue Service. I received the Form 499R2/W2PR and the bottom has a section which states that, according to Puerto Rico Internal Revenue Code of 11, an income tax return must be filed if "an individualwho during the taxable year had gross income greater than $5000".

Modified fields The 19 Form 499R2/PR W2PR added Boxes C and D to report services rendered in agricultural labor (Box C) and services rendered by a minister of a church or religious order (Box D) Control Numbers The Puerto Rico Treasury Department has reserved the sequence between and for internal use. The same printed Form 499R2c/W2cPR will be used for all purposes to deliver a copy to the Social Security Administration, to deliver two copies to the employee and to keep a copy for your records The Department will only accept electronic submissions via SURI. Therefore, the signNow web application is a musthave for completing and signing form 499r 2 w 2pr on the go In a matter of seconds, receive an electronic document with a legallybinding esignature Get form 499r 2 w 2pr signed right from your smartphone using these six tips Type signnowcom in your phone’s browser and log in to your account.

The W2PR section of the Print Preview menu allows you to create, preview, and print Forms W2PR, and create the 499R, the W3, and the Control Number reports To automatically create these files, PRPay retrieves the information from the Companies,. Example of Electronic Filing Confirmation Number Box on Form 499R2/W2PR II Control Numbers The Department of Treasury will no longer be assigning control numbers The control number will be assigned by the employer on submission This number must consist of nine. The same design of printed Form 499R2/W2PR will be used for all purposes to keep a copy for your records and to deliver two copies to the employee That is, there are no longer an Original and Copies A, B, C and D 2 Cost of employersponsored health coverage (RW Employee Wage Record,.

The same design of printed Form 499R2/W2PR will be used for all purposes to deliver a copy to the Social Security Administration, to keep a copy for your records and to deliver two copies to the employee. FORM 499R2c/W2cPR ELECTRONIC FILING REQUIREMENTS FOR TAX YEAR 16 Analysis and Programming Division January, 17 EFW2CPR i WHAT’S NEW New Field 1 Date of Birth (E0 Employee Wage Records, positions ) 2 Exempt Salaries (Box 16A), (E1 Originally Reported Records, positions 248 258), (E2 Correct Information Records, positions 248. Purpose of this Publication To provide the electronic transfer filing instructions for Form 499R2/W2PR Copy A (W2) using the EFW2PR format Users of this Publication Employers submitting Form 499R2/W2PR by text file Mandatory Electronic Filing You must file all employee wages records electronically through SURI using EFW2PR format.

Form 499R2/W2PR (Withholding Statement) This withholding statement is the Puerto Rico equivalent of the US Form W2 and should be prepared for every employee The form comes in five copies. Puerto Rico has released Publication 1704, which contains the specifications for Form 499R2/W2PR reporting There are a number of changes from last year’s release Modified Fields Exempt Salaries Code (Box 16), (RS State Record, positions ) Blank field (RS State Record, positions ), (can be filled with blanks or zeros). Forms W2 of US possessions References to Form W2 on Form 59 and in these instructions also apply to Forms W2AS, W2CM, W2GU, W2VI, and 499R2/W2PR However, for Form 499R2/W2PR, Medicare wages and tips are reported in box 19 and Medicare tax withheld is reported in box.

The same design of printed Form 499R2/W2PR will be used for all purposes to keep a copy for your records and to deliver two copies to the employee The Social Security Wage Base for Tax Year 17 is $127,0 The Contributions to CODA PLANS cannot exceed $24,000. Form 499r2/w2pr (copy a) electronic filing requirements for The same design of printed Form 499R2/W2PR will be used for all If you have less than 250 of these forms you can use the 17 W2 &. Form # lw2pr 1a l252 formulario formulario form form 499r2/w2pr 499r2/w2pr rev 0816 rev 0816 estado libre asociado de puerto rico commonwealth of puerto rico estado libre asociado de puerto rico commonwealth of puerto rico departamento de hacienda department of the treasury departamento de hacienda department of the.

On the dotted line next to Form 1040, line 38, enter the amount excluded and identify it as “EPRI” Also attach a copy of any Form (s) 499R2/W2PR to your return Any amount on Line 45 or Line 50 of Form 2555, Foreign Earned Income Any amount on Line 18 of Form 2555EZ, Foreign Earned Income Exclusion.

Changes And New Items Added To The Informative Declarations Torres Cpa

Fillable Online Form 499r 2 W 2pr Fax Email Print Pdffiller

Fillable Online Form 499r 2 W 2pr Fax Email Print Pdffiller

Form W 3c Pr Transmittal Of Corrected Wage And Tax Statements 14 Free Download

2

Http Www Hacienda Pr Gov Sites Default Files Publicaciones 14 11 Publication 14 04 Pdf

Download Instructions For Irs Form 59 Additional Medicare Tax Pdf Templateroller

Irs 17 Instructions For Form 59 Pdf 17 Department Of The Treasury Internal Revenue Service Instructions For Form 59 Additional Medicare Tax Course Hero

Form 1040 Ss U S Self Employment Tax Return Form 14 Free Download

Http Hacienda Gobierno Pr Sites Default Files Publicaciones 19 10 Publication 19 01 Pdf

Puerto Rico Releases 17 Specifications For Form 499r 2 W 2pr Reporting Sovos

Puerto Rico S Treasury Department Announces New Services And Transact

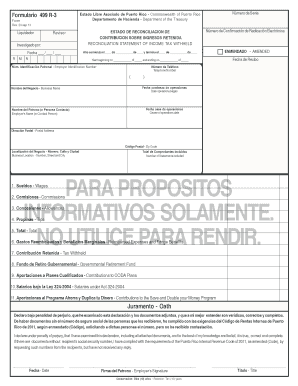

499 R 3 Fill Online Printable Fillable Blank Pdffiller

Preparing A Corrected W 2 Form

Www Ssa Gov Employer Efw 18efw2 Pdf

Http Www Hacienda Pr Gov Sites Default Files Publicaciones 19 10 Publication 19 02 Pdf

Instrucciones Para El Anexo H Pr Formulario 1040 Pr Pdf Free Download

About

Internal Revenue Bulletin 18 29 Internal Revenue Service

Fillable Online Form 499r 2 W 2pr Fax Email Print Pdffiller

Puerto Rico Tax Compliance Overview White Paper Puerto Rico Luxury

Setting Up Youth Wage Tax Exemption For Puerto Rico

Http Www Hacienda Pr Gov Sites Default Files Publicaciones 17 12 Publication 17 04 Pdf

Miperfil Colegiocpa Com Download Php Id

Http Hacienda Pr Gov Sites Default Files Publicaciones 14 12 Publication 14 05 Pdf

2

Irs Form W 3pr Download Printable Pdf Or Fill Online Transmittal Of Withholding Statements English Puerto Rican Spanish Templateroller

Www Irs Gov Pub Irs Prior Fw3pr 13 Pdf

Form As Request For Extension Of Time To File The Withholding Statement 499r 2 W 2pr And The Reconciliation Statement Of Income Tax Withheld 499 R 3 14 Printable Pdf Download

Formulario W 2pr W 2c Para Formulario De Presentaci Oacute N Electr Oacute Nica W2pr En L Iacute Nea Software W2pr

Form W 3 Pr Informe De Comprobantes De Retencion Transmittal Of Wi

Http Www Hacienda Gobierno Pr Sites Default Files Publicaciones 14 07 Publication 13 05 Pdf

Http Www Hacienda Pr Gov Sites Default Files Publicaciones 12 Publication 01 1 Pdf

Puerto Rico Electronic Filing Requirements Kpmg United States

Http Www Hacienda Pr Gov Sites Default Files Publicaciones 14 11 Publication 14 04 Pdf

Formulario 499r 2 W 2pr Fill Out And Sign Printable Pdf Template Signnow

Form As Request For Extension Of Time To File The Withholding Statement 499r 2 W 2pr And The Reconciliation Statement Of Income Tax Withheld 499 R 3 14 Printable Pdf Download

Fill Free Fillable Form 4137 19 Unreported Tip Income Pdf Form

Http Hacienda Gobierno Pr Downloads Software Manualw203 Eng Pdf

Fill Free Fillable Form W 3pr Informe De Comprobantes De Retencion 17 Pdf Form

W 2 Pr

Www Ssa Gov Employer Efw 19efw2 Pdf

Form 499r 2 W 2pr Copy A Electronic Filing Requirements For Tax Year 16

Http Www Hacienda Gobierno Pr Sites Default Files Publicaciones 18 11 Publication 18 03 Pdf

Electronic Filing Requirements For Forms 499r 2 W 2pr Grant Thornton

2

Form 499r 2 W 2pr Copy A Electronic Filing Requirements For Tax Year 16

Epoca De Planillas Comprobante De Retencion W 2pr Y Formulario 480 Microjuris Al Dia

Modelo Sc 27 Departamento De Hacienda De Puerto Rico

Assets Kpmg Content Dam Kpmg Us Pdf 19 10 194 Pdf

Form W 3 Pr Informe De Comprobantes De Retencion Info Copy Only

Http Www Vgmmcpa Com Images Tax Alert 16 03 Pr Department Of Treasury Issues New Withholding Statement And Informative Return Forms Pdf

Ano Year Comprobante De Retencion

Short Form 1998 Departamento De Hacienda

Visionms Net W2showto18 Pdf

Http Hacienda Gobierno Pr Downloads Software Manualw203 Eng Pdf

Http Www Hacienda Pr Gov Sites Default Files Seminario 12 4 18 Rev 12 2 18 1 Pdf

Http Www Hacienda Pr Gov Sites Default Files Publicaciones 19 10 Publication 19 02 Pdf

Fillable Online Form 499r 2 W 2pr Copy A Electronic Filing Requirements Fax Email Print Pdffiller

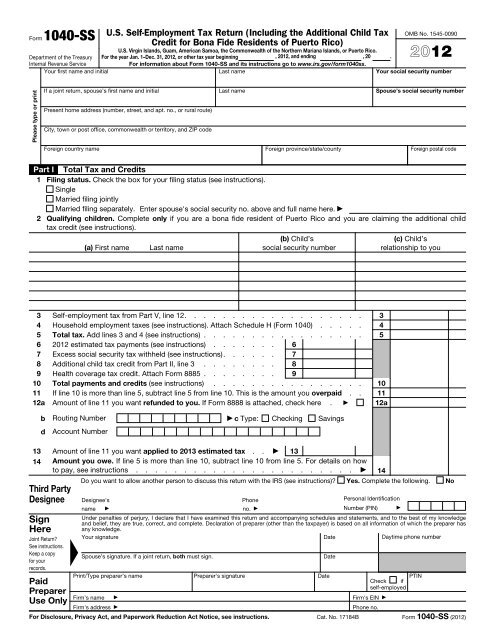

12 Form 1040 Ss Internal Revenue Service

2

Miperfil Colegiocpa Com Download Php Id

Thrupike It S Like Getting Your Back Office For Free

Printing Carrier Forms Paper Filing For Each Employer

Long Form Departamento De Hacienda

Http Www Hacienda Gobierno Pr Sites Default Files Publicaciones 16 12 Publication 16 04 Pdf

Formulario W 2pr W 2c Para Formulario De Presentaci Oacute N Electr Oacute Nica W2pr En L Iacute Nea Software W2pr

2

What Is Irs Form 59 How To File It A Illustrated Guide

Www Irs Gov Pub Irs Pdf Iw3cpr Pdf

2

Printing Carrier Forms Paper Filing For Each Employer

19 Electronic Filing Requirements For Form 499r 2 W 2pr Grant Thornton

Download Instructions For Irs Form 59 Additional Medicare Tax Pdf Templateroller

New Services And Transactions On The Suri Portal

Http Www Hacienda Pr Gov Sites Default Files Publicaciones 17 12 Publication 17 04 Pdf

Formulario W 2pr W 2c Para Formulario De Presentaci Oacute N Electr Oacute Nica W2pr En L Iacute Nea Software W2pr

499r 2 W 2pr Fill Out And Sign Printable Pdf Template Signnow

Form 1040 Ss U S Self Employment Tax Return Including The Additional Child Tax Credit For Bona Fide Residents Of Puerto Rico

Instrucciones Para El Anexo H Pr Internal Revenue Service

Form W 3 Pr Informe De Comprobantes De Retencion

Instrucciones Para El Anexo H Pr Internal Revenue Service

Http Www Hacienda Pr Gov Sites Default Files Documentos Short Return 00 Pdf

2

Social Security Administration Data Operations Center Wilkes Barre Pa Solo Para Adultos En Honduras

Printing W2 Pr S For Each Employee

Manual De Usuario Comprobante De Retencion 499r 2 W Acceso آ Gobierno De Puerto Rico Departamento

Http Www Hacienda Gobierno Pr Sites Default Files Publicaciones 17 01 Publication 16 05 Pdf

Visionms Net W2showto18 Pdf

Form 499r 2 W 2pr Copy A Electronic Filing Requirements For Tax Year 16

Mef Update Fta Tax Technology Conference Boise Id Internal Revenue Service Presented By Juanita Wueller A Ugust 4 Ppt Download

2

Fema Puerto Rico Photos Facebook

Form W 3 Pr Informe De Comprobantes De Retencion Transmittal Of Wi