499r 2w 2pr 2020

Product Updates And Releases Valiant

Form W 3pr Internal Revenue Service Save Your Free Paper Now Cocosign

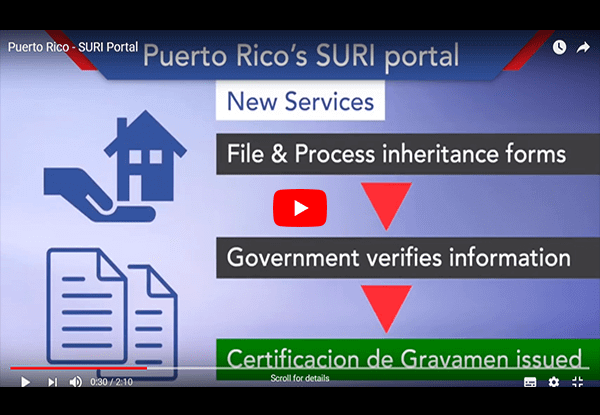

New Services And Transactions On The Suri Portal

Disaster Relief Puerto Rico Employee Retention Credit Final 6 21

Internal Revenue Bulletin 36 Internal Revenue Service

Dpto De Hacienda V Twitter Patrono Recuerda Que Los Comprobantes De Retencion 499r 2 W 2pr Mejor Conocidos Como Las W 2 Y Su Estado De Reconciliacion 499r 3 Correspondientes Al Ano Contributivo 19 Deben Someterse Electronicamente

I only made $3000 total in Puerto Rico for the year, and I was taxed by my company for US federal income and PR income I received the Form 499R2/W2PR and the bottom has a section which states that, according to Puerto Rico Internal Revenue Code of 11, an income tax return must be filed if "an individualwho during the taxable year had gross income greater than $5000".

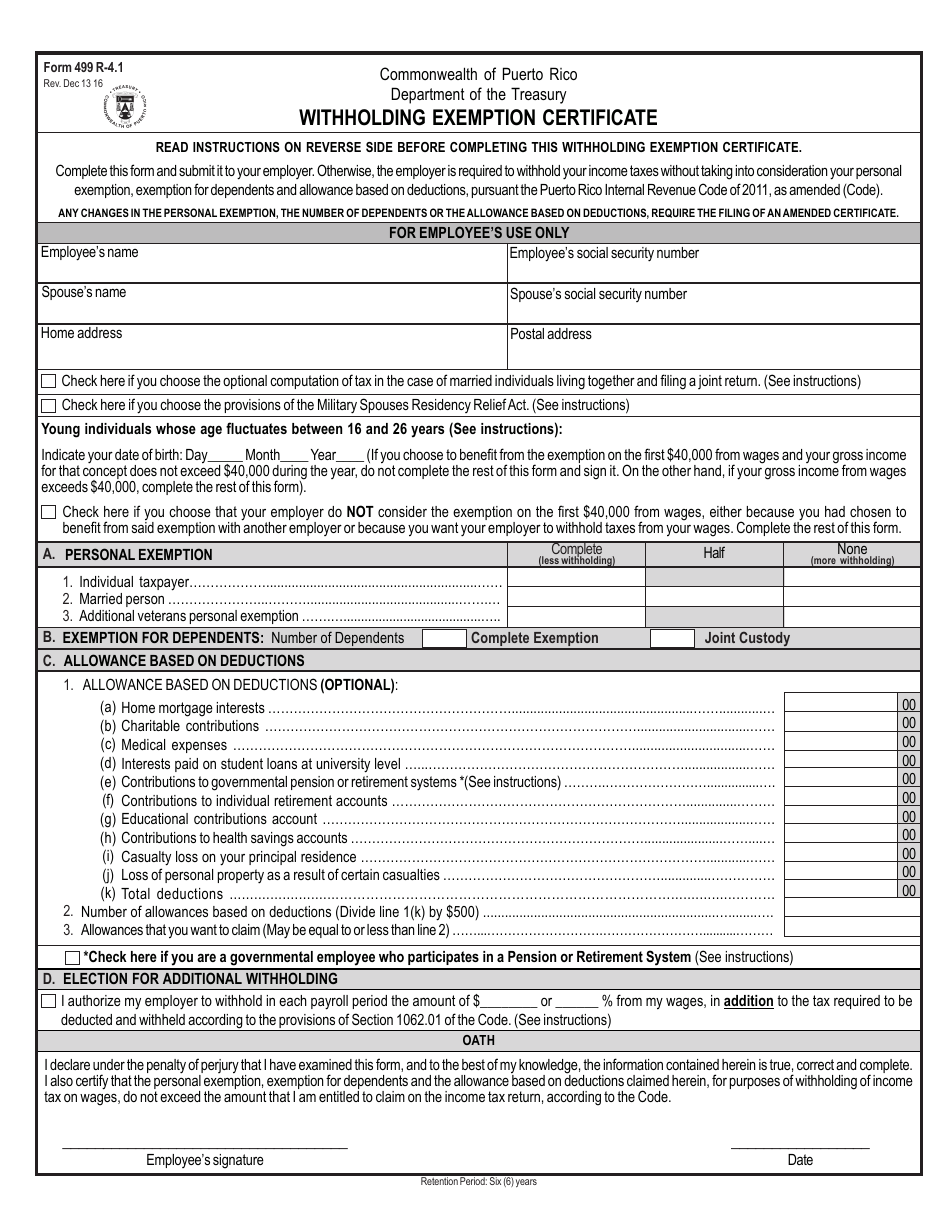

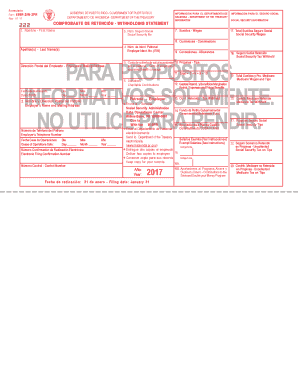

499r 2w 2pr 2020. INFORMACIÓN PARA EL SEGURO SOCIAL SOCIAL SECURITY INFORMATION Formulario Form 499R2/W2PR Rev 07 GOBIERNO DE PUERTO RICO GOVERNMENT OF PUERTO RICO DEPARTAMENTO DE HACIENDA DEPARTMENT OF THE TREASURY Fecha de radicación 31 de enero Filing date January 31 Costo de cubierta de salud auspiciada por el patrono Cost of employer. Filers have until March 31, , to electronically submit these reports for the 19 tax year The requirements are different in DC For more information on those and on the wider shift toward statelevel ACA compliance reporting, be sure to read our blog post Understanding changes to Puerto Rico Forms 499R2/W2PR. General Consulting Section at (787) 721 extension 3611 or toll free (1) (800) , Monday through Friday from 800 am to 430 pm 11 RECORDS SPECIFICATIONS Code SU Submitter Record Location Field Length Specifications 12 Constant Record Identifier 2 "SU".

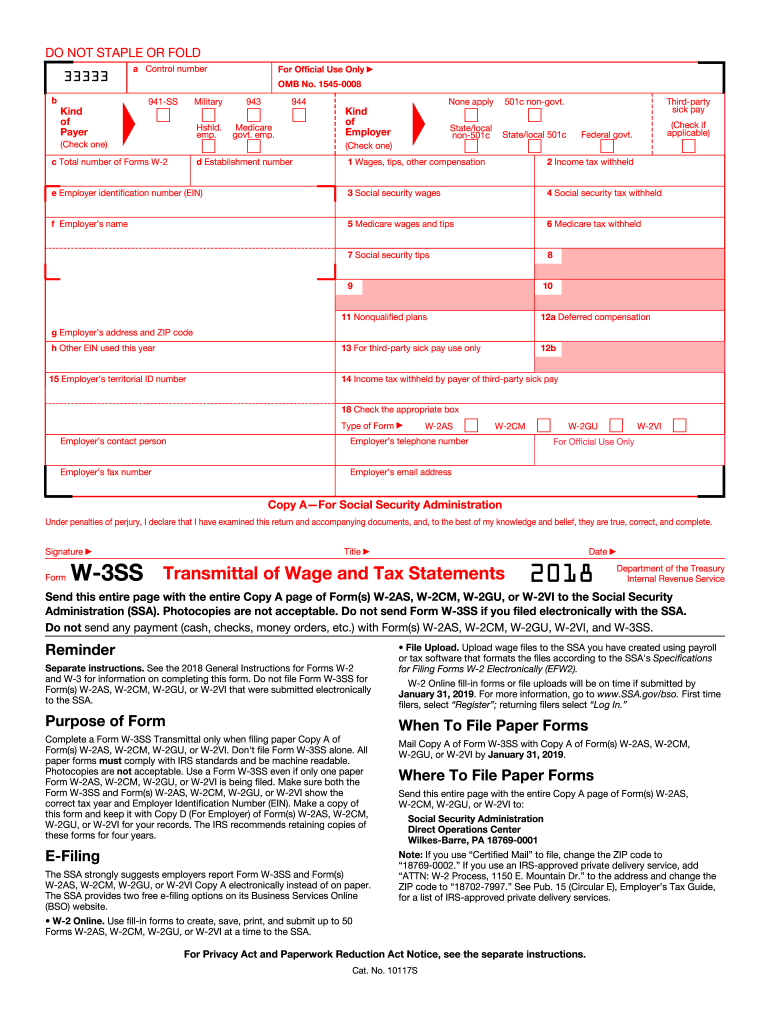

499R2/W2PR Make sure that both Form W3PR and Form 499R2/W2PR show the correct tax year and employer identification number (EIN) Don’t file a photocopy of Form W3PR with the SSA However, make a copy of Form W3PR to keep with copies of your Forms 499R2/W2PR The IRS recommends retaining copies of these forms for 4 years. The deadline to file the 19 Form 499R2/W2PR with the Puerto Rico Treasury Department is January 31, A 30day extension is available by filing Form AS 2727, Request for Extension of Time to File the Withholding Statement and Reconciliation Statement of Income Tax Withheld, through SURI. How do I enter WPR?.

499r2/w2pr Fill out blanks electronically using PDF or Word format Make them reusable by making templates, add and complete fillable fields Approve documents by using a lawful digital signature and share them via email, fax or print them out Save documents on your PC or mobile device Enhance your efficiency with powerful service!. How do I enter WPR?. How do I enter WPR?.

499R2/W2PR Withholding Voucher We recommend you verify the list of all the suppliers to which you made payments in and collect all the required information of name and employer’s number, address and total or partial exemption if these apply, so you can prepare the forms. Effective beginning with 1099etc for , Advanced Micro Solutions will no longer be able to support updates to the Puerto Rico tax tables and forms and they will no longer be part of 1099etc If you use 1099etc to provide payroll or form preparation and filing services for your business or your clients that involve calculations and forms. Rate 499r 2 W 2pr as 5 stars Rate 499r 2 W 2pr as 4 stars Rate 499r 2 W 2pr as 3 stars Rate 499r 2 W 2pr as 2 stars Rate 499r 2 W 2pr as 1 stars 23 votes Create this form in 5 minutes or less Get Form Find and fill out the correct publication 18 03 signNow helps you fill in and sign documents in minutes, errorfree Choose the correct.

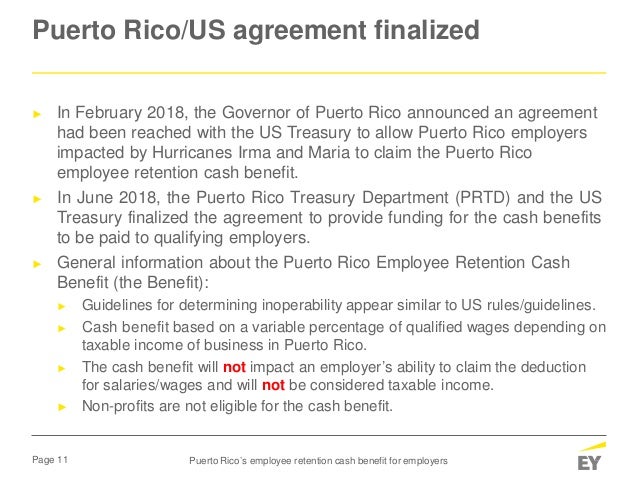

I have a 499r2/w2pr from working in puerto rico They have taken federal taxes out as well as medicare taxes, how do i file and must i file if i am not a PR resident?. In addition, all Qualified Payments made to employees shall be reported as exempt salary in Form 499R2/W2PR provided by the PRTD for year If the Qualified Payment is made to an independent contractor, it should be reported in Form 4806D for year. Title Country Author Sarai Perez Lopez Created Date 10/3/19 AM.

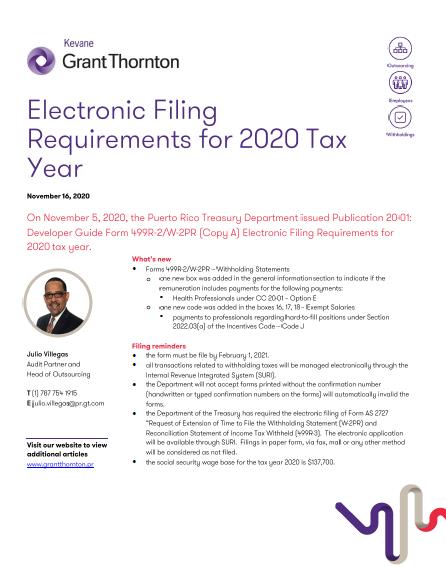

Form 499r2/w2pr Fill Online, Printable, Fillable Blank formw3prcom form 499r2/w2pr Online solutions help you to manage your record administration along with raise the efficiency of the workflows Stick to the fast guide to do Form W3PR, steer clear of blunders along with furnish it in a timely manner. The forms (499R2/W2PR) must be file by February 1, 21 the forms (4806A, 4806B, 4806D, & 4807F) must be file by March 1, 21 the forms (4806C) must be file by April 15, 21 the forms (4807E) must be file on or before the due date of the income tax return, including extensions. Enter the amount of your withheld social security, Medicare, and Additional Medicare taxes from Puerto Rico Form(s) 499R2/W2PR, boxes 21 and 23 If married filing jointly, include your spouse’s amounts with yours For information about Form 499R2/W2PR, go to the Departamento de Hacienda website at Haciendagobiernopr/.

499R2/W2PR Copy A (W2) using the EFW2PR format Users of this Publication Employers submitting Form 499R2/W2PR by text file Mandatory Electronic Filing You must file all employee wages records electronically through SURI using EFW2PR format Due Date Wage records for tax year are due February 1, 211 Register Online. Object Moved This document may be found here. The format is different than a regular W2 and I do not know how to enter in the information.

Follow the below procedures before creating your Electronic File and Printing your 499R2/W2PR Forms Important The preprinted forms that are needed for should be ordered through Puerto Rico This program will print the proper data in the appropriate boxes of the preprinted forms obtained from the government. Puerto Rico Releases Form W2PR Filing Rules Nov 9, , 846 PM Puerto Rico’s electronic filing specifications for Forms 499R2/W2PR, Withholding Statement, were released Nov 5 by the territory’s Departamento de Hacienda To read the full article log in. Your situation requires you to file two returns a Puerto Rico return and a US return.

INFORMACIÓN PARA EL SEGURO SOCIAL SOCIAL SECURITY INFORMATION Formulario Form 499R2/W2PR Rev 07 GOBIERNO DE PUERTO RICO GOVERNMENT OF PUERTO RICO DEPARTAMENTO DE HACIENDA DEPARTMENT OF THE TREASURY Fecha de radicación 31 de enero Filing date January 31 Costo de cubierta de salud auspiciada por el patrono Cost of employer. El secretario del Departamento de Hacienda (DH), Francisco Parés Alicea, recordó a todos los patronos que los Comprobantes de Retención (499R2/W2PR), mejor conocidos como las W2 y su Estado de Reconciliación (499R3), correspondientes al año contributivo 19, deben someterse electrónicamente a través del Sistema Unificado de Rentas Internas (SURI) en o antes del 31 de enero de. COMPROBANTE DE RETENCION 499R2/W2PR EN COLECTURIA VIRTUAL Rev 1131 COMPROBANTE DE RETENCION 499R2/W2PR 721 Ext 2415 a la 2422 COMPROBANTE DE RETENCION 499R2/W2PR MANUAL DE USUARIO Página 8 Colecturía Virtual IV Creación de Usuario Cree su perfil de usuario y una contraseña de 7 caracteres o más para poder.

The format is different than a regular W2 and I do not know how to enter in the information. Formulario 499R2 / W2PR Download Stars (0) 25 Downloads Owner Mas Version 10 Last Updated 2502 1726 Description Preview Versions 25 de febrero de EMPLEADOS DOCENTES Y NO DOCENTES, ESTUDIANTES A JORNAL Y ESTUDIO Y TRABAJO. The due date for filing Forms 499R2/W2PR and W3PR with the Social Security Administration (SSA) is February 1, 21, whether you file using paper forms or electronically Rejected wage reports from the SSA.

Form 499R2/W2PR, Withholding Statement – As part of the new provisions of the 19 Puerto Rico Incentives Code (Act 6019, as amended), the payments in excess of $100,000 to a professional of difficult recruitment are exempt from income tax The Form 499R2/W2PR, which is used to inform the wages of the employees,. February 3 IMPORTANT INFORMATION Purpose of this Publication To provide the electronic transfer filing instructions for Form 499R2c/W2cPR using the EFW2CPR format Users of this Publication Employers submitting Form 499R2c/W2cPR by text file. 499R2/W2PR Copy A (W2) using the MMW2PR1 format Users of this Publication Employers submitting Form 499R2/W2PR by text file Mandatory Electronic Filing You must file all employee wages records electronically through SURI using MMW2PR1 format Any other method of filing (mag media, CD’s, or paper) will not be accepted or.

A La Hacienda de Puerto Rico ha publicado los Formularios 499R2 para el año fiscal Este formulario es el equivalente en Puerto Rico del W2 Este formulario es el equivalente en Puerto Rico del W2. If you are not able to file by the January 31, due date, you may request a 30day extension through SURI using Form AS 2727 "Request for Extension of Time to File the Withholding Statement (499R2/W2PR) and Reconciliation Statement of Income Tax Withheld (499 R3)" All extensions must be requested prior to the filing due date Any. A n employer is required to withhold income tax at source upon the salaries and wages paid to its employees performing services in Puerto Rico In this connection, the employer is required to register its employer’s identification number with the Puerto Rico Treasury Department by filing Form SC 4809, Information of Identification numbers.

Nov 9, , 846 PM Listen Puerto Rico’s electronic filing specifications for Forms 499R2/W2PR, Withholding Statement, were released Nov 5 by the territory’s Departamento de Hacienda. Comprobante de Retención 499R2/W2PR Consulta de Notificación de Códigos de Acceso y Números de Control Validación y Transferencia de Archivo de W2,W2C e Informativa. INFORMACIÓN PARA EL SEGURO SOCIAL SOCIAL SECURITY INFORMATION Formulario Form 499R2/W2PR Rev 07 GOBIERNO DE PUERTO RICO GOVERNMENT OF PUERTO RICO DEPARTAMENTO DE HACIENDA DEPARTMENT OF THE TREASURY Fecha de radicación 31 de enero Filing date January 31 Costo de cubierta de salud auspiciada por el patrono Cost of employer.

Instructions for filing Form 499R2/W2PR Copy A (W2) information to the Department of the Treasury on magnetic media using the MMW2PR1 format If you do not have access to the Internet, call (787) 721 extension 4511 or send a fax to (787) or (787) , the Department of the Treasury will. The Puerto Rico Hacienda recently released Forms 499R2 and 499R2C for Tax Year 18 These forms are the Puerto Rico equivalent of the W2 and W2c (respectively), and must be filed with the Hacienda and the Social Security Administration by every employer that has paid wages with income tax withheld for Puerto Rico (or to correct any submissions in the case of the 499R2C). Filing deadline The deadline to file the 19 Form 499R2/W2PR with the Puerto Rico Treasury Department is January 31, A 30day extension is available by filing Form AS 2727, Request for Extension of Time to File the Withholding Statement and Reconciliation Statement of Income Tax Withheld, through SURI.

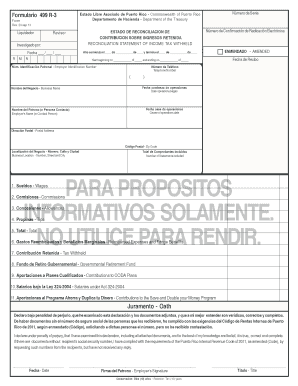

FOR TAX YEAR Submitting Annual W2 Information to the City of Dayton, Ohio Division of Taxation City Of Dayton, Ohio Department Of Finance indicated W2, W2CM, W2VI, W2GU, W2AS, 499R2/W2PR The term "W3" refers to W3, W3SS, and W3PR May I send a paper W3 or W2 along with my electronic media?. The format is different than a regular W2 and I do not know how to enter in the information. Formulario 499R2/ Form W2PR (Informativo) Comprobante de Retención – Withholding Statement (Para propósitos informativos, no utilice para rendir).

Publication 01 Developer Guide Form 499R2/W2PR (Copy A) Electronic Filing Requirements For Tax Year Regresar Publication 01 05/11/ Rentas Internas Descargar documento original Temas Comprobantes de Retención, Patronos Efiling Tipo de contribución Negocios. The deadline to file the 19 Form 499R2/W2PR with the Puerto Rico Treasury Department is January 31, A 30day extension is available by filing Form AS 2727, Request for Extension of Time to File the Withholding Statement and Reconciliation Statement of Income Tax Withheld, through SURIThe extension will be made available on the SURI portal after January 1,. Form 499R2/W2PR, Withholding Statement – As part of the new provisions of the 19 Puerto Rico Incentives Code (Act 6019, as amended), the payments in excess of $100,000 to a professional of difficult recruitment are exempt from income tax The Form 499R2/W2PR, which is used to inform the wages of the employees,.

FORM 499R2/W2PR (COPY A) ELECTRONIC FILING REQUIREMENTS FOR TAX YEAR 17 Analysis and Programming Division Rev December 6, 17 MMW2PR1 i WHAT’S NEW Modified Fields 1 Exempt Salaries Code (Box 16), (RS State Record, positions ) 2 Blank field (RS State Record, positions ), (could be with blanks or zeros). 499r2/w2pr 499r2/w2pr rev 0816 rev 0816 estado libre asociado de puerto rico commonwealth of puerto rico estado libre asociado de puerto rico commonwealth of puerto rico departamento de hacienda department of the treasury departamento de hacienda department of the treasury comprobante de retenciän withholding statement. 6 Se mostrarán los formularios 499R2/W2PR y si tiene 480 por concepto de retiros de cuentas IRAS, 401 o cualquier otro ingreso que haya recibido en 18 7 Descargue los documentos y guárdelos para adjuntarlos haciendo ‘upload’ a través del Portal Next, como parte del proceso de verificación.

No, do not include any paper W. See the separate Instructions for Form W3PR for information on completing this form Don’t file Form W3PR for Form(s) 499R2/W2PR that were submitted electronically to the SSA Purpose of Form Complete and file Form W3PR only when filing paper Forms 499R2/W2PR, Comprobante de RetenciónWithholding Statement Don’t file Form.

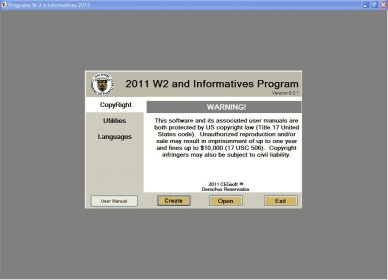

11 W 2 And Informative Returns Program Download This Program Generates Files With The Information Of The Withholding Statements

Form 499r 2 W 2pr Fill Online Printable Fillable Blank Form W 3pr Com

Download Instrucciones Para Irs Formulario W 3pr Informe De Comprobantes De Retencion Pdf Templateroller

Manual De Usuario Comprobante De Retencion 499r 2 W Acceso آ Gobierno De Puerto Rico Departamento

Setting Up Youth Wage Tax Exemption For Puerto Rico

Irs Form W 3pr Download Printable Pdf Or Fill Online Transmittal Of Withholding Statements English Puerto Rican Spanish Templateroller

October 19 Compliance Updates Aps Payroll

Http Hacienda Gobierno Pr Downloads Software Manualw203 Eng Pdf

Fill Free Fillable Form 4137 19 Unreported Tip Income Pdf Form

Puerto Rico Certificate Fill Free Photos

New Extended Due Dates For 19 Tax Returns As Result Of The Covid 19 Emergency Fpv Galindez Llc

Manual De Usuario Comprobante De Retencion 499r 2 W Acceso آ Gobierno De Puerto Rico Departamento

Jcgo7nresnbjxm

Changes To Reporting Requirements For Severance Payments In Puerto Rico Latam Law

Long Form Departamento De Hacienda

Fillable W2 Form Fill Online Printable Fillable Blank Form W 3pr Dubai Khalifa

Manual Acceso Comprobante Retencion Contrasena Negocios

.png)

Beneficios Del Departamento De Hacienda En Respuesta A Los Terremotos Ayudalegalpr Org

Www Colegiocpa Com Wp Content Uploads 02 Calendario Contributivo Pdf

Calendario Contributivo De Puerto Rico Septiembre Alchavo Com

Www2 Pr Gov Gobiernoagobierno Documents Manual acceso comprobante de retenci C3 n Pdf

Www Colegiocpa Com Wp Content Uploads 02 Calendario Contributivo Pdf

Tax Planning Checklist Rsm Puerto Rico

Electronic Filing Requirements For Tax Year Grant Thornton

Http Www Hacienda Pr Gov Sites Default Files Publicaciones 12 Publication 02 Pdf

Gobierno De Puerto Rico Departamento De Hacienda Manual De Usuario Comprobante De Retencion 499r 2 W 2pr En Colecturia Virtual Rev Pdf Free Download

Formulario 499 R 4 Unformulario

Form 480 Puerto Rico Page 1 Line 17qq Com

Treasury Secretary Urges Employers To Submit W 2 Forms Business Theweeklyjournal Com

Nuevos Servicios Y Transacciones Es Suri Pdf Free Download

Events Iofm Com Conference Spring Wp Content Uploads Sites 5 19 05 Mon 810 Changes In 1099 And 1042 S Reporting Mcouch Pdf

Www Irs Gov Pub Irs Pdf F1040ss Pdf

Fillable Online Form 499r 2 W 2pr Fax Email Print Pdffiller

Http Www Hacienda Pr Gov Sites Default Files Publicaciones 19 10 Publication 19 02 Pdf

Www Irs Gov Pub Irs Pdf Iw3pr Pdf

W2 Form

Www Colegiocpa Com Wp Content Uploads 02 Calendario Contributivo Pdf

Form 480 Puerto Rico Page 1 Line 17qq Com

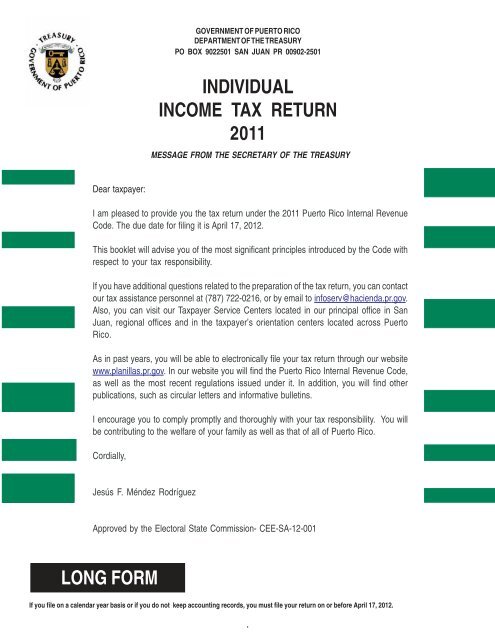

Individual Income Tax Return 11 Departamento De

Fillable Online Form 499r 2 W 2pr Copy A Electronic Filing Requirements Fax Email Print Pdffiller

1040 Us Excess Social Security And Tier 1 Rrta Tax Withheld

Payroll Tax Season Preparation

Formulario W 2pr W 2c Para Formulario De Presentaci Oacute N Electr Oacute Nica W2pr En L Iacute Nea Software W2pr

October 19 Compliance Updates Aps Payroll

09 Year End Processing Irs Tax Forms Tax Deduction

Formulario W 2pr W 2c Para Formulario De Presentaci Oacute N Electr Oacute Nica W2pr En L Iacute Nea Software W2pr

Como Obtener Copia De Tu W2 19 Rudilenia

October 19 Compliance Updates Aps Payroll

W3 Form 18 Pdf

Fillable W2 Form Fill Online Printable Fillable Blank Form W 3pr Dubai Khalifa

Electronic Filing Requirements For Tax Year Grant Thornton

Http Www Hacienda Pr Gov Sites Default Files Publicaciones 14 11 Publication 14 04 Pdf

Http Hacienda Gobierno Pr Sites Default Files Publicaciones 19 10 Publication 19 01 Pdf

W 3pr Form Easy To Download Edit And Print Cocosign

Kpmg S Week In Tax 7 11 October 19 Kpmg United States

Www Datadesign Co Docs taxcatalog Pdf

Formulario W 2pr W 2c Para Formulario De Presentaci Oacute N Electr Oacute Nica W2pr En L Iacute Nea Software W2pr

Disaster Relief Puerto Rico Employee Retention Credit Final 6 21

Fillable Online Form 499r 2 W 2pr Fax Email Print Pdffiller

Download Instructions For Irs Form 59 Additional Medicare Tax Pdf Templateroller

3

Payroll Tax Season Preparation

2

Fillable Online Form 499r 2 W 2pr Fax Email Print Pdffiller

Puerto Rico Tax Reform Impacts Retirement Benefit And Employment Law Provisions Sociedad Para La Gerencia De Recursos Humanos

P179 Publicacin 179 Contenido Circular Pr Qu Hay De Nuevo Cat No w Department Of The Treasury Internal Revenue Service Gua Contributiva Federal Course Hero

2

Puerto Rico Announces Changes To Reporting Payments

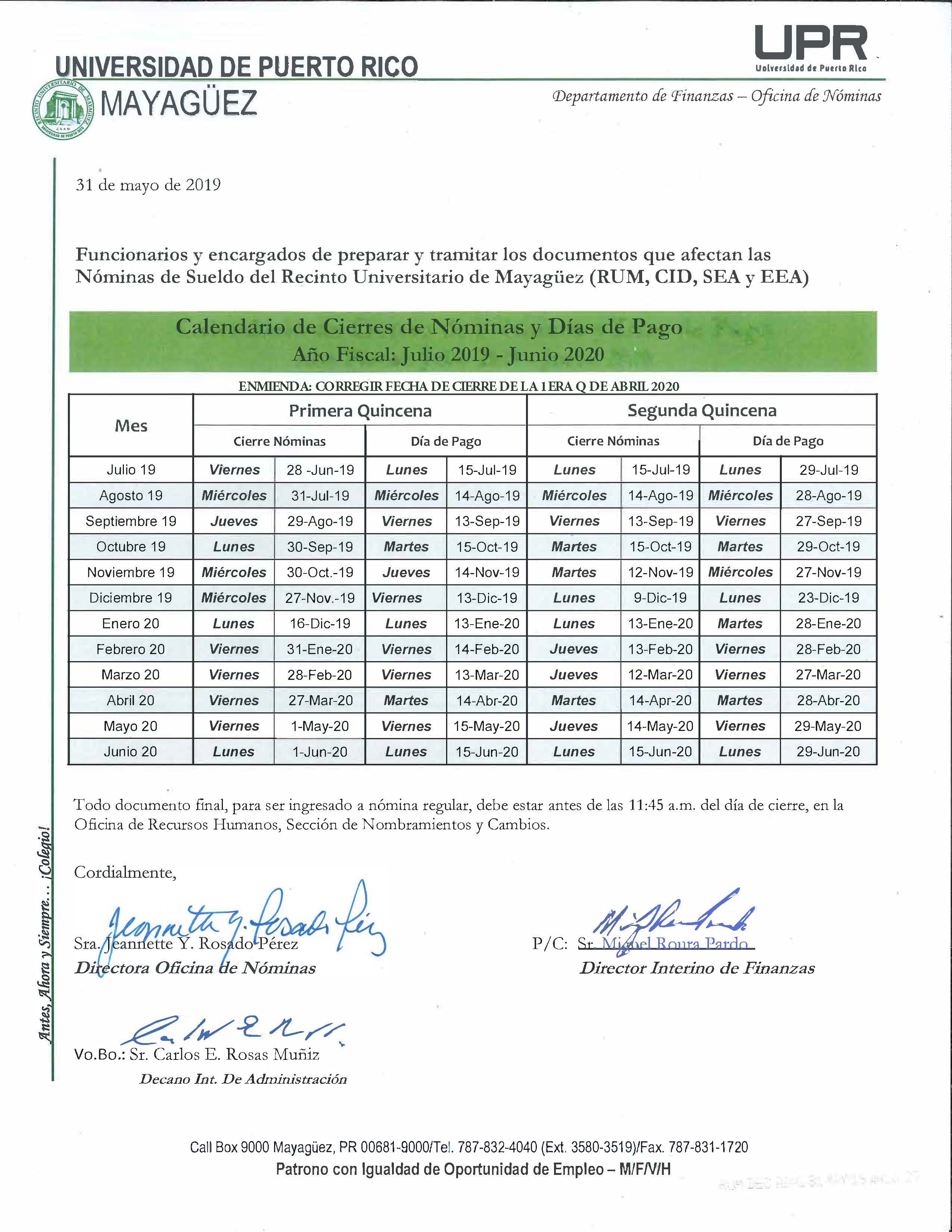

Calendario De Fechas De Pago Y Cierre De Nominas 19 Decanato De Administracion

Docs Oracle Com Cd E 01 Doc 93 E693 Pdf

Fill Free Fillable Form W 3pr Informe De Comprobantes De Retencion 17 Pdf Form

What Is Irs Form 59 How To File It A Illustrated Guide

Assets Kpmg Content Dam Kpmg Us Pdf 19 10 194 Pdf

Http Www Hacienda Pr Gov Sites Default Files Publicaciones 12 Publication 01 1 Pdf

Withholding Vouchers And Informative Declarations Torres Cpa

Www Ssa Gov Employer Efw efw2 Pdf

2

Instrucciones Para El Anexo H Pr Internal Revenue Service

Rdp Consulting Pr No Sabes Como Bajar Tus W2 Desde Suri Para Nuestros Clientes Estaremos Descargando Sus W2 Desde Suri Totalmente Gratis Asi Estaras Preparado Para Cuando Hacienda Inicie El Proceso

October 19 Compliance Updates Aps Payroll

Guam W 2gu Fillable Printable Pdf Sample

Www Ceridian Com Qepacketdf

Http Www Hacienda Gobierno Pr Sites Default Files Publicaciones 18 11 Publication 18 03 Pdf

Puerto Rico Electronic Filing Requirements Kpmg United States

Postponement Of Due Dates For The Filing And Payments Of Taxes As A Result Of The Earthquakes In The Southern Region Of Puerto Rico Torres Cpa

Due Dates Extended As A Result Of The Recent Earthquakes Fpv Galindez Llc

Http Www Hacienda Pr Gov Sites Default Files Publicaciones 19 10 Publication 19 02 Pdf

Patronos Y Agentes Retenedores Departamento De Hacienda De Puerto Rico

Www Colegiocpa Com Wp Content Uploads 02 Calendario Contributivo Pdf

W 2 Pr

Instrucciones Para El Anexo H Pr Internal Revenue Service

Long Form Departamento De Hacienda

Cayey Upr Edu Wp Content Uploads Sites 10 04 Cayey Instrucciones Para Obtener La W 2 Pr E Informativas Suri Pdf

499 R 3 Fill Online Printable Fillable Blank Pdffiller

L O Accounting Tax Services Photos Facebook